There are a lot of factors to consider when you’re looking to set your pricing. Whether you’re setting your pricing strategy for the first time for a brand new product or service, or reviewing your current pricing in the hope of increasing profits, you need to consider all available approaches and assess which is best for your business. There are three main pricing strategies we recommend you investigate to make an informed decision – Cost Plus Pricing, Competitive Based Pricing and Value Based Pricing. In this article we’re going to look at Competitive Based Pricing.

Competitive Based Pricing is a common strategy where the price points of your competitors play a major part in setting your own pricing. Let’s look in more detail…

What is Competitive Based Pricing?

Competitive Based Pricing (or Competition Based Pricing) is a pricing model where your price points are heavily influenced by those of your competitors. This approach focuses outwardly on the market, rather than inwardly on your costs (Cost Plus Pricing). It is often used when you have a similar product or service to competitors.

Competitive or Competition Based Pricing opens up a few different approaches. Here are three examples:

Lowest Cost Offerings:

Being the lowest cost option in a market is one of the strategic positions you can take (see Bowman’s Strategy Clock for others) using Competitive Based Pricing. When you’re in this position you’re providing the product or service at a price that is perhaps even below cost.

Being the Lowest Cost Offering is a viable choice for some companies, but you need to either establish how you eventually migrate customers to higher profit options or be careful that your margins don’t disappear.

Premium Price Points:

The opposite to Lowest Cost Offering, here you’re charging a premium rate and positioning yourself above the competition. To achieve this successfully you need a strong brand and/or differentiation at a product and service level. To maintain this price position you need to continually innovate and stay ahead of the curve.

Price Match Promises:

Famous in the supermarket space, the Price Match Promise is where a company will commit to matching the price of the competition on particular items. It works well if you can’t predict or research competitor price points, but are sure that you can match them. Given the risk involved, as your cost base may be different to those you match, this particular method is more suited to companies that provide more than one product or service.

How do I set my pricing using Competitive Based Pricing?

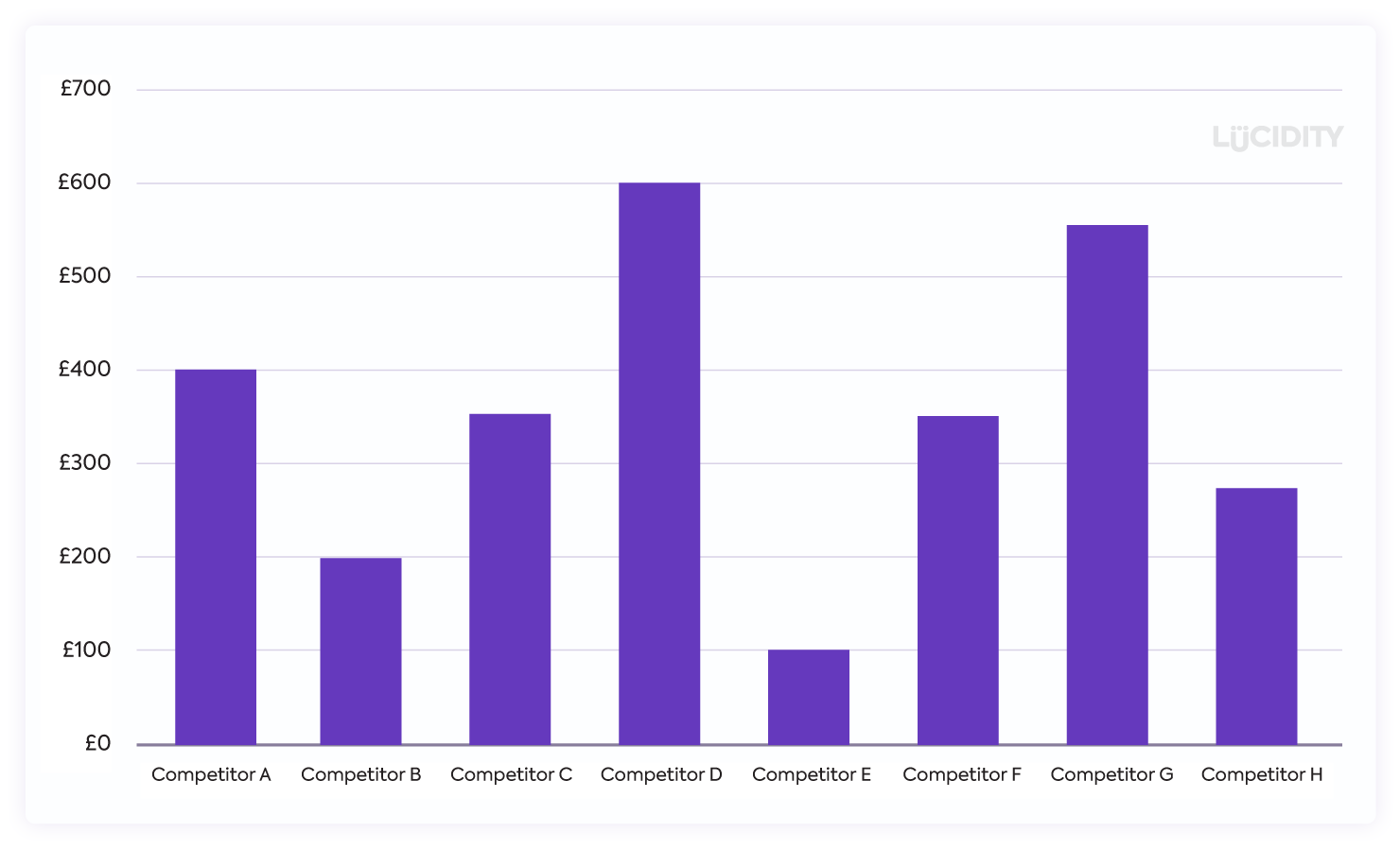

Competitive Based Pricing relies on researching your competitors and their offerings in order to factor those price points into your own consideration. One approach to collating this data is to chart the prices against each other in order to decide where you should be placed.

Keep in mind that while Competitive Based Pricing has competitor price points as the major factor, you should still consider your cost and desired profit.

What are the advantages to Competitive Based Pricing?

There are several advantages to Competitive Based Pricing, including:

- Customers will not be surprised by your price points

- Competitors have likely done some research into pricing so you will benefit from that

- It’s a quick approach to price points

- You can add pressure onto a market by entering at a low cost

- You will be seen by potential customers as a viable option cost-wise

- You’ll gain insight by keeping a close eye on how competitor prices change

What are the disadvantages of Competitive Based Pricing?

The disadvantages of Competitive Based Pricing include:

- Your cost-base is likely to be different to competitors, so profit is at risk

- You are heavily pressured by external competitors’ price points

- You have less in-house insight into what price is acceptable to your customers

- Competitive advantage on price may be short lived as competitors adapt

- It’s rare to successfuly position yourself as the highest cost or premium option

When is Competitive Based Pricing the right approach to take?

Competitive Based Pricing works best for the following situations:

- Start-ups, as this gives a quick route to an acceptable market price before you’ve had a chance to understand your perceived value (Value Based Pricing) and removes the risk of setting your price too high or low (Cost Plus Pricing)

- Companies with a need for speed to market

- Highly competitive markets with many suppliers

- Mature marketplaces where consumers have anchored expectations

- Companies with multiple products where some can be Competitive Based Pricing

When is Competitive Based Pricing the wrong approach to take?

You won’t get the best result from Competitive Based Pricing in the following situations:

- You want a Value Discipline of customer intimacy and operational excellence

- You intend to maximise company profits

- You wish to position yourselves as innovative or new

- The market you’re entering is new

- You’re planning for longer-term positioning and growth

Criticisms against a Competitive Based or Competition Based Pricing approach can be that you are using pricing that is not your own – it’s your competitors. Basing your pricing on their pricing could be seen as confirming both their price and their leadership in the market. It can be very difficult to reconcile a Competition Based Pricing approach if you are trying to position yourself as new or innovative. Competitive Based Pricing can work initially as a stop-gap for new businesses and products, but it’s worth considering Value Based Pricing as a longer-term solution if you’re looking to differentiate yourself from your competitors.

What is an example of Competitive Based Pricing?

Here are a few examples of businesses that may adopt a Competitive Based Pricing strategy.

- Retailers

Retailers who are selling the same products as their competitors frequently use Competitive Based Pricing, as potential customers often compare prices for their desired items and make a purchase decision based on price. This is especially prevalent in the online space were Google’s Shopping feature makes price comparison easy for consumers.

Amazon is a well-known example of an online retailer who conducts large-scale and ongoing analysis of competitor pricing with the aim of being the lowest-price option in the market.

-

Apple

It could be argued that Apple adopt a Competitive Based Pricing strategy, but opt for the Premium Pricing approach. Apple consistently charges above the prices of it’s competitors and has branding, marketing and messaging that works hard to justify the higher price points. -

Coca Cola

The Coca Cola Company has a vast range of products that they sell into multiple global markets, and, as such, will implement a wide range of different prices strategies. However, for the most part, if we look at the Coca Cola product alone, they operate a Competitive Based Pricing strategy, closely tracking the price of their biggest competitor Pepsi.

What are the alternatives to Competitive Based Pricing?

Alternatives to Competitive Based Pricing include Cost Plus Pricing, where you simply take your unit cost and add a mark-up to give your desired profit margin, and Value Based Pricing where you price your product or service based on the perceived value you believe your customers place on your offering. You can read about both in detail in our Pricing Strategy Guide.

What are the tools used for Competitive Based Pricing?

Here at Lucidity, we’re a big fans of using strategic planning models and frameworks to help direct your thinking, give you insight and inform your decision-making. When considering a Competitive Based Pricing strategy, a highly complementary framework we’d recommend is the Five Forces or Six Forces model. This model will enable you to map out the different pressures on your company in order to determine how profitable a marketplace might be for you. Another helpful models is Four Corner Analysis, to establish a competitor strategy and so understand if their pricing may change.

So, there is some detail on the Competitive Based Pricing approach. As we said at the start, this is just one of the possible pricing strategies and it’s worth finding out about all the options so you can be confident you are making an informed decision.

Be sure to download our Pricing Strategy Guide to get the complete picture on your pricing options and decide on the right strategy for your business.