This guide will help you understand the nuances of cost plus pricing and how to implement it in your business.

Getting your pricing right is famously one of the hardest aspects of any business strategy… but it can also make the biggest impact on your profit. It’s important to do your homework first and understand all the possible pricing options so you can make an informed decision about what would be best for your business.

With that in mind, in this article we’ll look at one of the three possible pricing strategies typically adopted by businesses. Those three strategies are Competitive Based Pricing, Value Based Pricing and Cost Plus Pricing method. Here we’ll look at Cost Plus, probably the simplest of the strategies. Adopting a Cost Plus approach is the easiest way to cost your products and services but has a number of drawbacks compared to the alternatives. Is it right for you? Let’s read on and find out more…

What is Cost Plus Pricing?

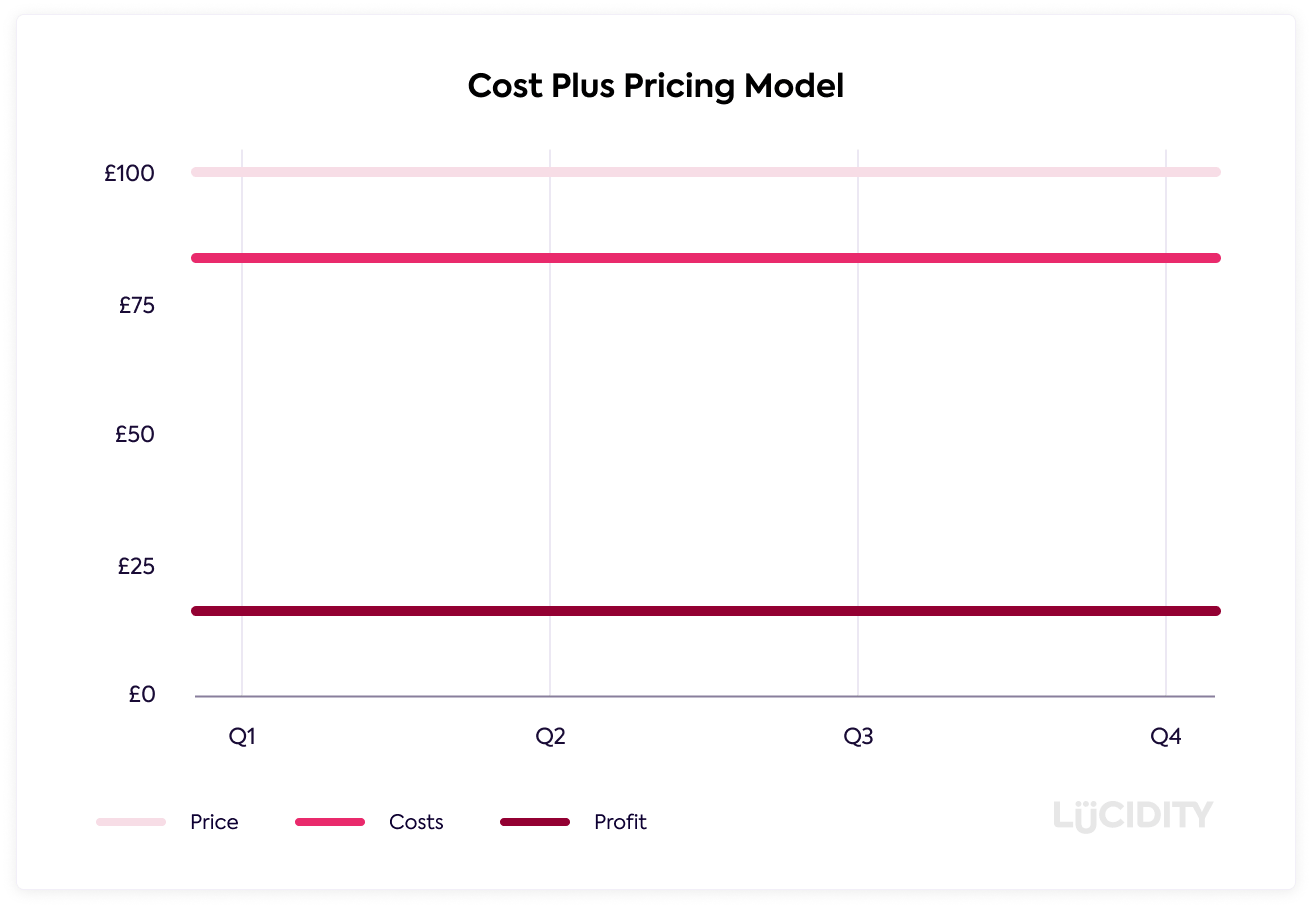

Cost Plus Pricing is a very simple pricing strategy where you decide how much extra you will charge for an item over the cost. For example, you may decide you want to sell pies for 10% more than the ingredients cost to make them. Your price would then be 110% of your cost.

How do I set my pricing using Cost Plus Pricing?

Don’t worry, it couldn’t be easier! The formula to set your Cost Plus Pricing is as follows:

Price = Cost x Desired Profit Margin

or

Price = Cost + Desired Profit

Working out your true cost per unit or service may be a bit more complicated. You should factor in total cost to the business when looking at Cost Plus, in order to ensure you make a profit. For example, if you were to base your pricing solely on the manufacturing fixed costs of a product and not take into account marketing or operations, you may end up making a loss.

So think about everything it takes to get your product made and in the hands of customers. Consider your cost of sale, not just production costs. This is the only research you’ll need to do for Cost Plus Pricing, and it’s all internal and easily to hand. Just look though your invoices and overheads and you’ll find your total cost per unit.

What is Cost Plus Pricing also known as?

Cost Plus Pricing is sometimes referred to as Mark-up Pricing, and it’s clear to see why. This pricing strategy is all about taking a number and adding a fixed mark-up. It is your cost with your desired mark-up applied to give your price point.

What are the advantages to Cost Plus Pricing?

The advantages of adopting a Cost Plus Pricing strategy include:

- It being simple to use and understand

- No requirement for research into the rest of the market, your competitors or even your customers

- Guaranteed profit per unit item or service delivered as all costs are being covered

- Rapid to get to market

- Easy to increase prices if costs go up or unaccounted for costs occur

- Simple justification for price increases should you need to communicate that to your customers

What are the disadvantages of Cost Plus Pricing?

The disadvantages of the Cost Plus Pricing strategy include:

- Your costs will keep changing so your pricing will need to follow

- You could be giving a lot of value away

- It is very inward looking so susceptible to external risks

- It doesn’t cultivate a culture of innovation or cost analysis

- It doesn’t factor customers into the price points

- It doesn’t factor competitors into the price points

- When costs overrun it directly impacts profit

When is Cost Plus Pricing the right approach to take?

Cost Plus Pricing is good for certain situations. You might be a simple business or a business that provides services. Cost Plus Pricing also works well for resellers or businesses with many different products, where some items may be Cost Plus whilst others take a different approach.

When is Cost Plus Pricing the wrong approach to take?

If you’re looking to maximise your profit or you’re in a market with many competitors, Cost Plus Pricing probably isn’t for you. Actually for most companies, Cost Plus Pricing is likely the wrong approach to take. Good pricing requires you to factor in different aspects, such as customers and competitors, so we’d recommend you go for Competitive Based Pricing or Value Based Pricing instead.

Cost Plus Pricing is disconnected from customer experience. This pricing strategy does not allow for consideration of the customers’ desire to pay that price. A customer does not care about manufacturing costs, or marketing overheads, they only consider how important the product or service is to them and how much that benefit is worth to them.

If you suspect your product or service offers considerable value to your customers – that it will significantly help them solve a problem or make their life easier – then you may be seriously under-selling your product or service if you follow a Cost Plus Pricing strategy. And, of course, underselling means you are not achieving your profit potential.

If you’re in a market with competitors selling the same, or very similar products to you, and they are not operating a Cost Plus Pricing strategy then you run the risk of losing custom to them. If you are not considering competitor pricing, and particularly if you have applied an aggressive markup, then you run the risk of your prices being higher than your competitors. And without any customer perception of extra value for that higher price, you may lose out.

How does Cost Plus Pricing affect supplier behaviour?

Most businesses use suppliers to provide the products they sell, help them make their product or deliver their service. If using a Cost Plus Pricing strategy your suppliers hold a lot of power over your business, more than with any other pricing strategy. Because your supplier’s price to you immediately and directly impacts the price you are passing onto your customers. That position does not put you in a very strong position for any negotiations and causes a risk to your business.

If you’re considering Cost Plus Pricing, it’s worth taking a look at Porter’s Five Forces and finding out more about the Supplier Power dimension of that model. It will help you understand the risks involved when your suppliers have a significant amount of power.

What is an example of Cost Plus Pricing?

There are a few examples of businesses where Cost Plus might be being used.

-

Small supermarkets and grocery stores

Most people have an idea of how much a pint of milk costs, or a carton of eggs, and that’s because most supermarkets and grocery shops work on a Cost Plus basis and have the same unit prices onto which they are applying their mark-up. They will often be purchasing their stock from the same wholesaler or producer, and with Cost Plus Pricing, that means we are used to seeing similar prices no matter where we buy our milk! -

A corporate training group

A training business that provides learning and development for company employees may use a Cost Plus strategy if they operate by using freelance consultants and trainers. That training company will add a charge (their mark-up) on top of the freelance day rate (their costs) to come to their price.

Cost Plus is often the weakest pricing strategy, so while simple and often used in the above examples, we’re not advocating it!

What are the alternatives to Cost Plus Pricing?

Given Cost Plus Pricing isn’t the best route for most companies, the alternatives are important to understand.

One alternative strategy is Competitive Based Pricing. Here you study and research your competitors and factor in their price points when setting your own. With Competitive Based Pricing you are considering your prices relative to the alternatives that are available in the market.

Another strategic option when setting your pricing is Value Based Pricing. Here you are more focused on your customers and are seeking to understand the true value you deliver for them. This is a hard strategy to get right, but it can be one of the most successful in terms of profit if you get it right.

But look, pricing is difficult – in reality you’ll probably be taking aspects of all three approaches. And, pricing should never be static – set once and left alone. You need to consistently and frequently review your pricing against aspects from all three pricing strategies to ensure you’re getting it right at any given time.

What are the tools used when setting Cost Plus Pricing?

As Cost Plus Pricing ignores any external factors, there are no frameworks or tools that are used in conjunction. You simply have to do some Cost Analysis in order to establish what your overall costs are, and then decide what margin you place on top. Simple… but not that effective 🤔.