To achieve your full potential as a business, you need to work on your pricing. There are multiple ways to do this, with different pricing strategies, from Cost Plus, to Competitor Based, to Value Based, but often the focus is on price point at the expense of the wider considerations that may impact your growth.

In this article we look at the Revenue Model Framework developed by Ron Meyer, Professor of Strategic Leadership. It’s designed to help you innovate around your price points and challenge your standard approach to making money.

Let’s take a look in more detail…

![Revenue Model Framework : How to Innovate Your Pricing 1 [FREE GUIDE] Learn How to Drive Strategy Formation from Experienced C-Suite Executives](https://no-cache.hubspot.com/cta/default/5961834/d01e9bd4-d9c0-486e-a6e4-1da95f48372b.png)

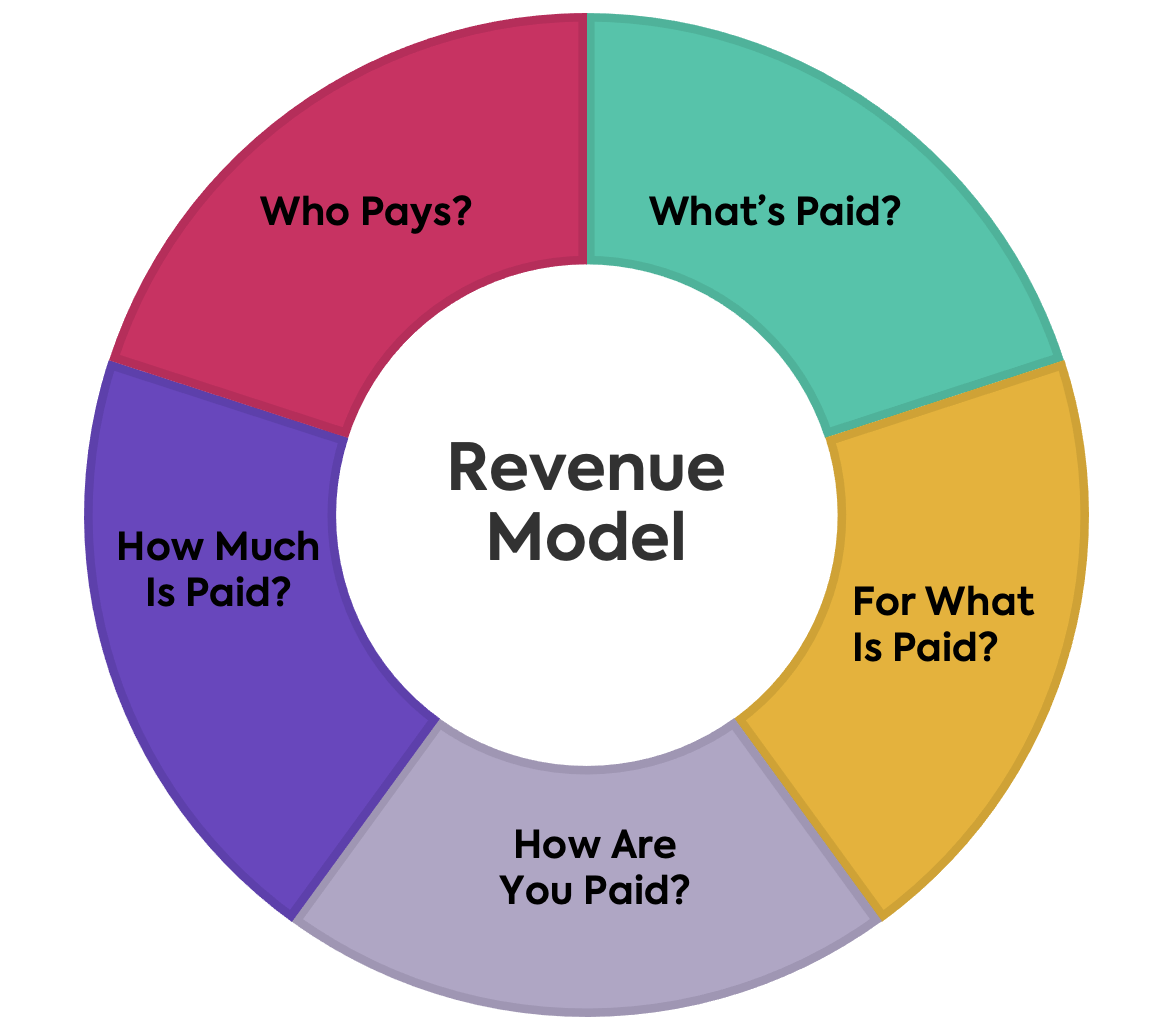

What is the Revenue Model Framework?

The Revenue Model Framework is a 5-part tool designed to help a company understand all aspects of their pricing in a market. It focuses not just on the price point, but also on other factors such as how payment is made or what is used as a currency.

The different questions are:

- Who pays?

- What is paid?

- What is paid for?

- How is payment made?

- How much is paid?

As you can see this model has 5 parts all of which have equal importance in how you monetise your business. Price point being just one part of it.

“Who Pays?” on the Revenue Model Framework

Who Pays? This is the first question in the Revenue Model Framework. It may sound a simple question, as normally the answer is the end client, but it isn’t always the case. There may be other parties who would pay for the service. For example:

- Advertisers paying on platforms to reach audiences

- Partners paying to work with a company

- Sponsors paying to host or brand events

There are many successful businesses where the end user doesn’t pay a penny. Facebook or Freeview TV being great examples. So, in your business, who is best to pay?

“What Is Paid?” on the Revenue Model Framework

In many cases the answer to “What is paid?” will be money, but this isn’t exclusively the case. It could be other value generating assets such as:

- Data or Insight

- Getting clients to do certain activities or behaviours

- Referrals

- Newer systems such as Crypto

It is often the case that these payments are used in a second step to ultimately receive money. For example, with Facebook users ‘pay’ with their data, which is monetised via an advertiser platform..

“What Is Paid For?” on the Revenue Model Framework

Every day we encounter many different ways businesses monetise their products and services.

For example, you may go to the shop and a buy a Twix chocolate bar. That’s a simple per item transaction where you exchange money for your Twix.

Too many Twixs and you’ll sign up for the gym, which is a per user access or usage model. If you’re in the gym you’ll be offered classes or a Personal Trainer, both examples of Add-On pricing.

Finally, if you injure yourself, you’ll be approached by many lawyers offering no-win, no-fee models, otherwise known as Results Based.

This part of the Revenue Model Framework looks at what approach you’re using with your clients. Is it the best one for your business?

![Revenue Model Framework : How to Innovate Your Pricing 1 [FREE GUIDE] Learn How to Drive Strategy Formation from Experienced C-Suite Executives](https://no-cache.hubspot.com/cta/default/5961834/d01e9bd4-d9c0-486e-a6e4-1da95f48372b.png)

“How Are You Paid?” on the Revenue Model Framework

This question looks at how you are paid. Is it a lease? A one-off? A subscription? Credit?

An important consideration here is the idea of recurring revenue such as a subscription or monthly fees. This is really important, as it’s significantly easier to grow if you are on recurring revenue rather than one-off revenue.

The benefits include:

- It’s easier to innovate because you know how much money you can invest

- It’s easier to focus on customers as the relationships are ongoing

- This allows you to grow new revenue streams with existing customers

- Your company is more resilient even when times are tough, as you have your base revenues

- Customer experience improves because it’s so fundamental to success that you will give it focus in order to succeed

Moving to recurring revenues is something many companies are doing. Let’s take Apple as an example. They began with the Mac, but now have numerous products from phones to watches to tablets to headphones, all of which mean there’s less risk than if the company still sold just computers.

In recent years Apple have launched a huge number of services. Music, TV, Arcade, Fitness, a credit card, cloud storage, and more are all seeing users pay on a monthly or annual basis. This recurring revenue is extremely valuable and de-risks the company further as it grows.

"How Much Is Paid?" on the Revenue Model Framework

Finally, we’re at the price point discussion. This is traditionally where a lot of people gravitate when talking about their pricing strategy.

It covers areas such as:

- Your price point

- Discounts

- Volume pricing

- Dynamic pricing

We have a full Definitive Guide to Pricing Strategy on this very topic!

![Revenue Model Framework : How to Innovate Your Pricing 1 [FREE GUIDE] Learn How to Drive Strategy Formation from Experienced C-Suite Executives](https://no-cache.hubspot.com/cta/default/5961834/d01e9bd4-d9c0-486e-a6e4-1da95f48372b.png)

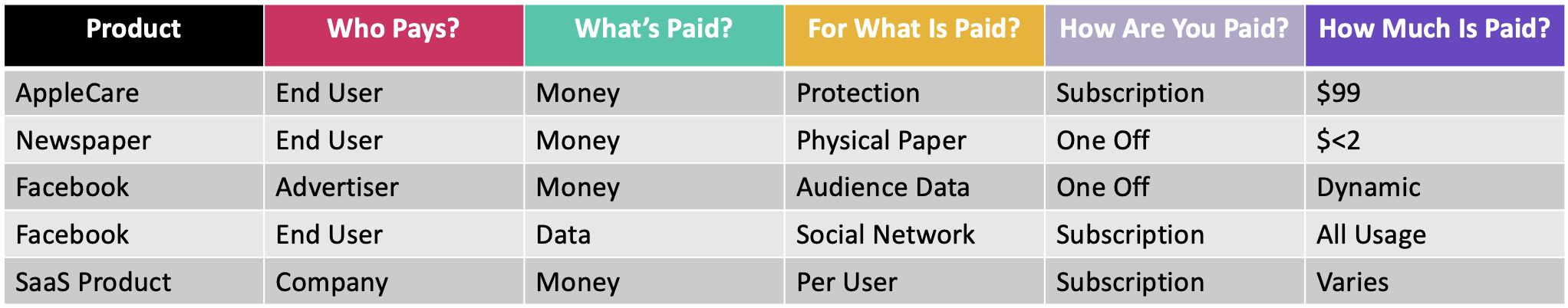

Examples of the Revenue Model Framework

Every product or service has a model behind it. Let’s take a look at some examples…

AppleCare is an insurance policy Apple provide for their products. The end user pays with money, for protection, via a subscription, at around £99 per year.

A newspaper is purchased by the reader with money for the physical paper as a one-off, at around £2.

With Facebook the advertiser pays money for audience data as a one-off each time they utilise the advert system, at dynamic price points.

Facebook also require a second revenue model, where the end user pays with their own data, to access the social network via a subscription.

Finally, a SaaS (Software as a Service) product is paid for by a company with money, often per user, on a subscription model.

Have a think about the items you pay for and what the models are behind the scenes.

Can a business have multiple Revenue Models?

Absolutely! Many businesses have multiple revenue models because it can bring a lot of benefits, including:

- Multiple products reducing risk, as you’re less reliant on market conditions that may impact one of them. As one declines others may rise.

- Your products may also complement each other, resulting in both growing stronger because of the other.

- Your company will find new opportunities by developing new revenue streams, expanding knowledge and capability.

- In general it’s easier to innovate. Companies with more than one revenue stream find it easier conceptually to ret different models (maybe moving to recurring revenue), than companies that are reliant on a single activity.

What are the advantages to the Revenue Model Framework?

There are a lot of advantages to the Revenue Model Framework including:

- It’s a simple and easy to use system

- It can help boost a company revenue and profit

- It helps broaden the discussion beyond price point

- It covers all areas of price discussion

Who invented the Revenue Model Framework?

The Revenue Model Framework was invented by Ron Meyer, Professor of Strategic Leadership at Tilburg University, as part of the Meyer’s Management Models.

Key Takeaways on the Revenue Model Framework

Ok, some key takeaways as we wrap this guide up!

Firstly, develop your whole Revenue Model, don’t just focus on one part of it. And even if you have a successful revenue model, challenge it with this framework.

Secondly, the most successful companies have multiple revenue models. They generate value in different ways. Remember the Facebook example, where users essentially give up their data to use the system, whilst advertisers pay for that data, or the Apple example where they have multiple products and services.

Finally, lean towards recurring revenues. If you can find a model that works and is recurring, you’re more likely to grow longer term.

The Revenue Model is a great, innovative way to capture all your thoughts about pricing. Good luck with it!

![Revenue Model Framework : How to Innovate Your Pricing 1 [FREE GUIDE] Learn How to Drive Strategy Formation from Experienced C-Suite Executives](https://no-cache.hubspot.com/cta/default/5961834/d01e9bd4-d9c0-486e-a6e4-1da95f48372b.png)