Samsung Electronics is a South Korean multinational conglomerate which was founded in 1938. They have a large product portfolio that has popularity spanning different demographics. Be it smartphones, televisions, watches, or appliances, most homes have some sort of Samsung product in them.

More recently, they have taken a look at smart appliances. We’re going to take a look at one of those – the Family Hub Fridge Freezer, otherwise known as the Family Hub. It’s a a smart fridge that contains functionality around food management, communication and entertainment. And, it also tells the weather… but then what smart device doesn’t?

To look at the strategic factors facing it we’ll use PESTLE, SWOT, and Five Forces.

PESTLE Analysis for Samsung Fridges:

A PESTLE analysis highlights economic, technological and environmental factors as most influential for Samsung’s Family Hub. In general, we’ve seen an increase in smart technology demand across all ages and this is stimulating R&D and marketing in businesses such as Samsung. Equally, rising incomes and reducing costs means smart technology is becoming an accepted part of everyday life.

Let’s take a look at some highlights from the PESTLE…

Political:

- Brexit could have a huge impact, particularly as Samsung EU headquarters are in London, but the production base for the technology is in Poland, thus affecting UK imports. Additionally, high barriers could be created by reducing EU trade and benefits from single market.

- GDPR enforcement. The privacy law gives consumers more control and increases businesses’ responsibility over privacy and marketing, including marketing of new products such as the Family Hub.

Economic:

- Rising UK Interest Rates promotes saving and discourages spending, with reduced disposable income for target audience due to the savings being made

- Strong exchange rates will alter profits overseas. It’s currently unpredictable with exchange rates fluctuating, meaning there could be positives and negatives to the profit Samsung make from £ products

- GDP per capita. More consumers with larger disposable incomes will consider purchasing larger appliances

Social:

- Rising interest in smart technology across all ages mean an expanded target demographic

- Older demographics are adopting smart technology which could impact the Samsung marketing strategy

- Rising incomes increases demand for high quality products

- Increased demand for the new products across all areas stimulates competitors to broaden their product range and quality.

- Increase in SMM. Effective advertisement without traditional costs

Technology:

- Rising technological abilities opens new opportunities

- Enhanced product innovation from consumer expectations and competitors wanting to enter the smart appliance industry

- More businesses seeking to utilise growth opportunities

- Maintain first mover advantage and heighten R&D into new models and products

- Rising consumer interest in expanding their smart product collection

Legal:

- Heightened home appliance regulation

- Intellectual property sensitivity with patents and copyrights preventing competitors from copying existing products

Environmental:

- Rising concern of food wastage and sustainability.

- Avoidable food waste is growing with 11.3 million metric tonnes coming from UK households and retailers

- Eco-focused initiatives will stimulate further consumer interest

- Increased ethical expectations of firms

- Rising globalisation raises demand for firms to be socially responsible.

- Awareness of plastic waste’s environmental damage encourages firms to use recyclable/bio-degradable materials.

This analysis suggests Samsung should consider reducing prices to encourage spending and consider marketing modifications to widen their target audience and promote their food management functions in line with current environmental concerns.

Read the Ultimate Guide to PESTLE Analysis.

Five Forces for Samsung Fridges:

Porter’s Five Forces shows that the threat of new entrants within this industry is high from existing technology manufacturers, the high barrier to entry meaning new companies appearing is unlikely.

Industry Rivalry: Medium

- Smart fridges face little direct competition as a product category

- Smart technology has high predicted growth

- No direct competition to Samsung. Closest rival is LG’s interactive fridge

- Potential competition of cheaper models with more functions

- Samsung’s market share could decrease with rivalry

New Entrants: High

- High barriers to entry due to large financial investment required

- Saturation of home appliance and smart product markets makes new entrants unlikely

- Predicted industry growth is attractive to existing smart product competitors

- Potential loss of customer base who prefer iOS to Android

- Existing technology suppliers (e.g. Apple) may move into smart fridge space over time due to attractive revenues

Substitution: Low

- Limited alternative products, those that are present are cheaper and not as sophisticated

- Example: Smarter’s FridgeCam (£149.99) which monitors the fridge’s contents through an app

- Cheaper substitutes may prevent Samsung’s customer base expansion

Supplier: Low

- Suppliers are easy to find and have low switching costs

- Although a unique product, Samsung’s monopoly status reduces bargaining power

- Samsung thrive on trusted supplier relationships and providing local supplier opportunities

- Suppliers are small-scale relative to Samsung, thus decreasing bargaining power

- Samsung is an important customer to suppliers thus their power is reasonably low

Buyer: Medium

- Unique product leads to low buyer power

- Target segment are early adopters so more willing to pay higher prices

- Few products on offer meaning less options for buyers

- Samsung brand has certain qualities that support new products

You can learn more how to create your own Five Forces here.

SWOT for Samsung Fridges:

Strengths:

- Global brand awareness

- Intellectual property

- First mover advantage

- R&D and innovative workforce

- Strong supplier and retailer relationships

Weaknesses:

- Restricted target audience

- High price deterring buyers beyond early adopters

- Infrequent online marketing

- Entire smart industry has high competition

Opportunities:

- Growth of smart living

- Market share increase following product portfolio expansion

- Celebrity endorsement to increase brand awareness

- Environmental agency support regarding sustainability

Threats:

- Market share loss from competitors diversifying

- Cheaper new entrants/substitutes

- Declining/stagnating incomes reducing spending

- Brexit

Read the Ultimate Guide to SWOT Analysis.

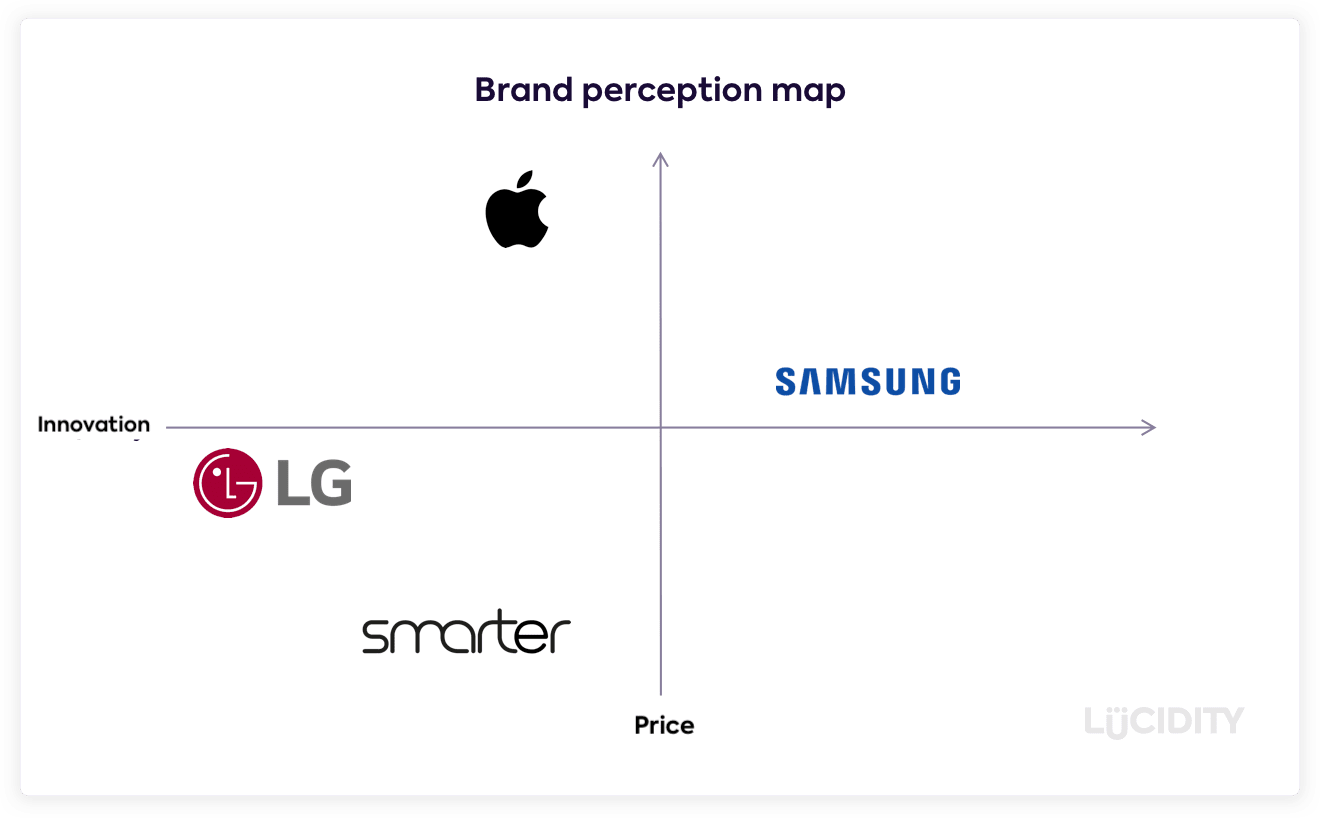

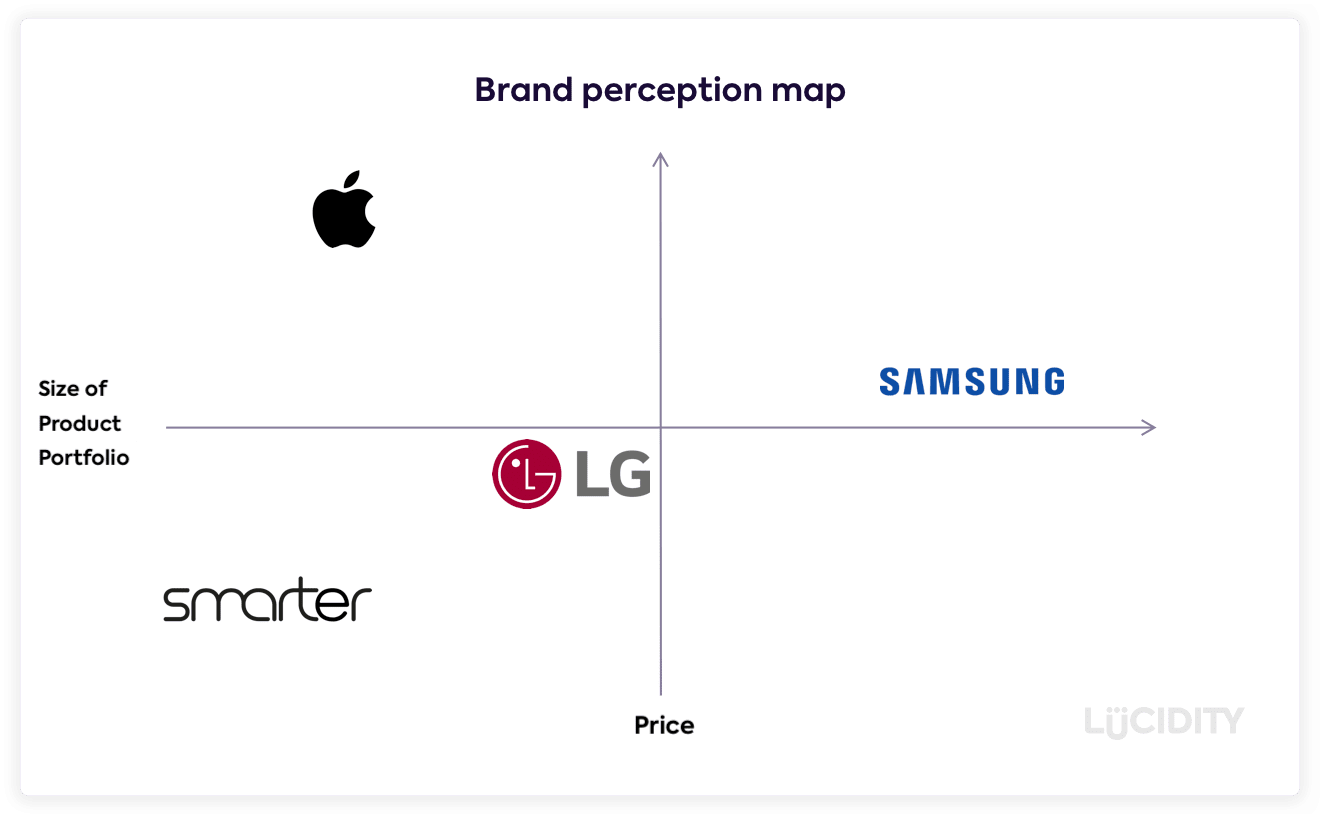

Perceptual Map for Samsung

We’ll look at Samsung’s overall smart products positioning, which encompasses the Family Hub. This represents Samsung’s positioning better, rather than singularly positioning the Family Hub considering the lack of competition.

Samsung’s product range is anticipated to increase with larger innovation through product development, which is in line with Samsung’s marketing objectives of positioning the company as innovation driven.

Learn more about Perceptual Maps here.

Summary

The analysis of the changing external environment highlights technological, economic, socio-cultural and environmental drivers as those with the largest influence on the Family Hub.

The current smart appliance industry is uncompetitive but this is a very early market and we can see a high threat of competition in the future. Like all smart device categories, fridges will become by default smart over time. Samsung will need to adapt or offer a range of smart fridge devices, especially as expectations begin to rise.

Despite this, they’re currently in a strong position and are leading the way in smart kitchen device innovation, which is a pretty ‘cool’ position to be in (groan!).

Need help building your own strategy?

Our strategy software makes it faster and easier to formulate a strategy, manage the execution and track the results. Book your personal demo and get a strategy plan template tailored to your organization.