If you’re considering your future strategy, divesifying your business or launching a new one then doing some industry analysis is really important. It’ll ultimately make sure you’ve a much higher chance of success!

The main objectives when you’re looking at industry analysis are as follows:

- To inform decision making and de-risk your actions

- To understand how an industry is structured

- To evaluate how attractive it is for you to enter that industry

- To predict the future of that industry

- To aid development of a successful strategy

In this guide we’ll look at:

- Defining Your Industry

- Defining Your Market Structure

- Evaluating Potential Profitability

- Predicting Future Impacts

There are two major factors to consider when looking at any industry. Firstly, the external factors that may be impacting it, and secondly the industry environment itself, and the different players that interact within it.

Defining Your Industry

The first job is to define your industry. That may seem obvious but you’ll actually find, that in most cases, industries can be defined in multiple ways. For example, are LG TVs part of the television industry or the home entertainment industry? Would BMW be part of the motor manufacturing industry, or the luxury car market?

The other consideration when defining your industry is the geographic spread. You might be local, regional, national, international, truly global… this will have a big impact on deciding how you judge your market growth opportunities later.

Top Tip: Defining Industry via Government Codes

One way to define your industry is to use the government coding for the different industries within your country. These will be different per country. For example, in the US these are called NAICS codes, while in the UK they are referred to as SICS. The added advantage of starting with these codes is that often research and market data aligns to these classifications.

At best this will provide you with a clear definition of your market, at worst they are great lists to get you started.

Defining A Market Structure

Once you’ve established your industry, it’s time to look at the economic structure of the market.

There are four market structures that can be used to define an industry at a current point in time. But markets can move between these states due to competitive activity or external forces. The four categories are:

Perfect Competition

Perfect Competition markets have multiple buyers and sellers, similar products or services, and alternatives that are present for users. Going back to our earlier example, the Home Entertainment Industry is one where there are a large number of suppliers looking to sell products to a large number of buyers and sellers, and these products are largely quite interchangeable at the different quality levels on offer.

Characteristics of Perfect Competition:

- Large number of buyers and sellers

- Price transparency for buyers

- No single dominant seller or brand who can control price

- Products or services largely are interchangeable

- Little or no barrier to entry for right type of company

- Quality at different levels doesn’t vary between sellers

Examples of Perfect Competition:

- Foreign exchange

- Agriculture

Monopolistic Competition

In this type of market structure the products and services sold differentiate themselves from each other either in terms of quality, features, or branding. They remain close to each other in their end result (for example, a Big Mac vs a Whopper), but buyers are likely to have a preferred choice.

Characteristics of Monopolistic Competition:

- High number of buyers and a lot of sellers in the market

- Differentiation between products or services in quality or brand

- Buyers have a preference for particular sellers

- No single market dominator

- Sellers have some influence on pricing but price is a factor for buyer decision

Examples of Monopolistic Competition:

- Fast food industry

- Hotel industry

Oligopoly

In oligopoly markets there are a small number of sellers who dominate the market, producing products that have a few differences but are quite similar. It’s a really common market structure.

Characteristics of Oligopoly:

- Small number of sellers dominating market

- Some barrier to entry

- Products or services do have differences

Examples of Oligopoly:

- Car industry

- Newspapers

- Pharmaceutical

Variance on Oligopoly: Duoply

The Duoply market is a type of oligopoly but where there are only two players. It’s usually the case that both players in the market are large firms and highly successful, having a whole industry just to themselves. But equally there will be aggressive competition and a battle for supremacy.

Characteristics of Duoply:

- Two sellers in the marketplace serving many buyers

- Price points set by the two players

- Little choice for buyer

- Product or service interchangeable but with differences

Examples of Duoply:

- Coke and Pepsi

- Android and iOS

Monopoly

A monopoly is the most commonly known market term and it’s where a single firm has no close competition. There will be numerous barriers to entry, questions around price control, and concerns about the behaviour of the single seller involved.

Characteristics of Monopoly:

- One main player with no real competition

- Very high barriers to entry

- Price control by one player

- Little choice for buyers

- Interest / concern on the market from government / public

Examples of Monopoly:

- Google search engine

- Microsoft Windows in the 1990s/00s

Industry Profitability

At this point you’ve established your market definition and the type of market structure. It’s now time to look at the potential profitability of a marketplace.

There are several influences on your industry profitability:

- The value of the product or service

- The level of competition

- The power of suppliers in the supply chain

- The risk of new entry or substitution

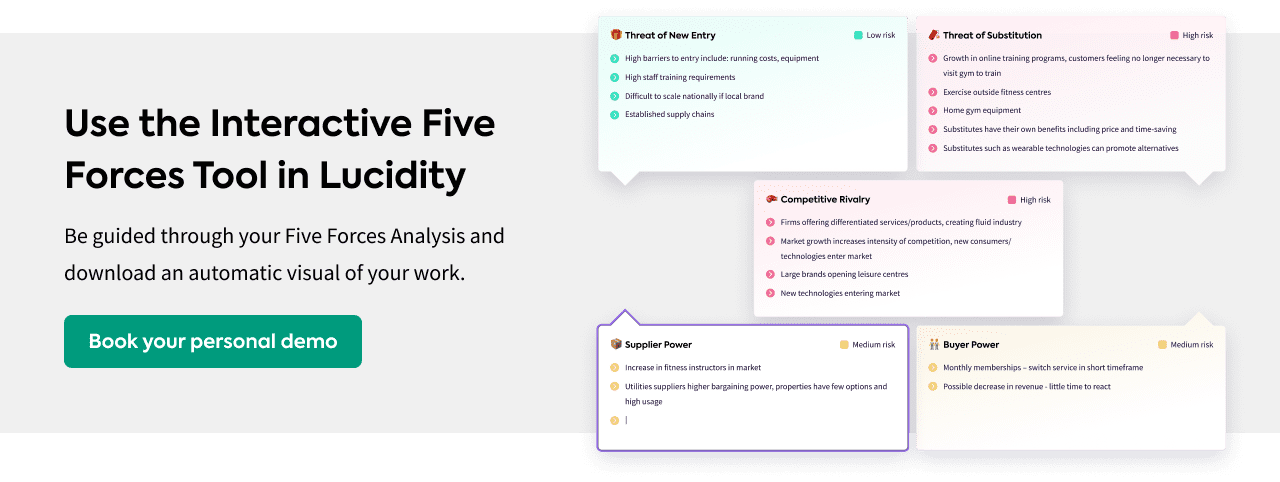

The most popular tool to use when establishing your industry profitability potential is Porter’s Five Forces. Using this framework you map out the factors in each category and award it a high, medium, or low influence on your profitability. If all forces are low, you’re in a strong position. If all forces are high, you’re in a weak position. The reality is likely to be something in the middle.

In recent years, a Sixth Force has been added around Complementors. These are products and services that will impact your profitability. For example, if a company produces phone cases they will be impacted when new phone models are released with different dimensions. They are likely to see an increase in the sales but also need to manufacture new cases. Check out our full guide to Porter’s Five Forces.

Examining the Environment

In order to have a clear view on the industry you may enter or are in, you must look at the external factors that could impact the business.

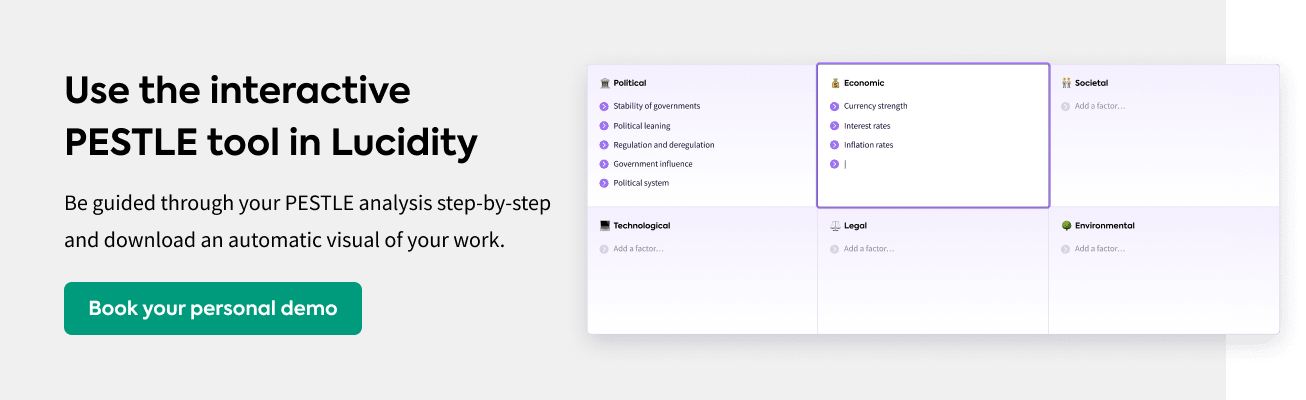

PESTLE Analysis

PESTLE Analysis is a framework that is commonly used to map out all of the different factors that could impact your market or business. It divides your analysis into different sections, such as Political or Economic, and is often done on a country level. You can take a look in more detail at our guide to PESTLE.

LoNGPESTLE Analysis

If your decision on geography from earlier has suggested you’re a business that is global, LoNGPESTLE may be a better option than PESTLE. It takes the core elements and adds the concept of Local, National or Global, into the classification. You can read more in our guide to LoNGPESTLE.

Example Factor Examples

This is a tough section and it requires a lot of thought and research, so to help get you started we’ve put together a list of many external factors that may impact your business. You still need to consider which are right for you, add new ones, and talk about their impact, but it certainly helps to kickstart that analysis!

Picking Your Strategy

The final part of your industry analysis is to recommend your position within the marketplace. You may be considering entering it at a low price point or diversifying towards it as a premium brand. A few considerations at this point will help:

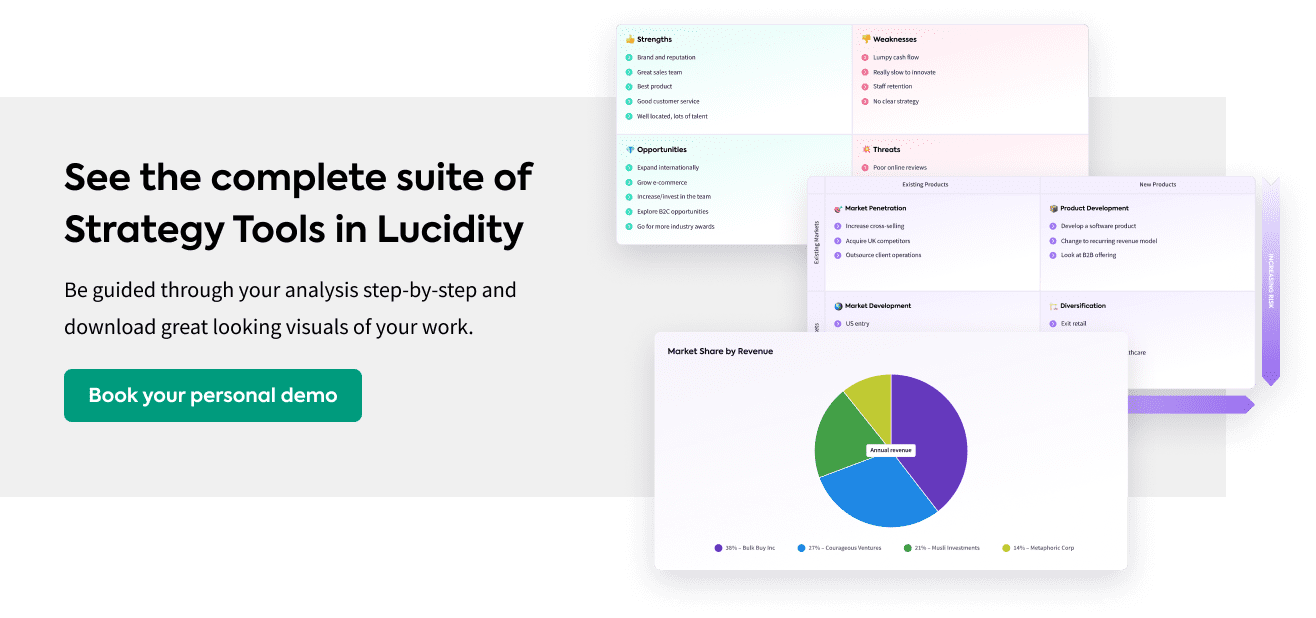

SWOT Analysis

Combine the external research you’ve done with the internal analysis of a SWOT in order to generate a good list of strengths, weaknesses, opportunities and threats. Consider the SWOT as your summary of how and why your company would perform in a certain way when operating in the industry. Read more in our full guide to SWOT.

Bowman’s Strategy Clock

Take a look at the Bowman Strategy Clock to understand different possible positions within a market. This will help you with some starter options of how you could approach it. Check out the full guide to Bowman’s Strategy Clock.

Key Success Factors

The final part of your analysis are the key success factors needed for success within the marketplace. Consider the following two questions:

- What do the buyers in the industry want?

- How are current sellers in the market remaining competitive?

You’ll generate a list for both which may include things like:

- Low production cost for seller

- Low price point for buyer

- Easily accessible for buyer

- Multiple supply chains for seller

It’s important that each of these KSFs can be achieved in line with your chosen strategic position and SWOT.

Final words…

There’s quite a lot to be getting on with there, but conducting industry analysis is so crucial to making smart business decisions that it’s worth the time and effort.

If you’re considering moving into a new industry, starting a business or simply just want to regroup, rethink and revise your business strategy, then you should start here. Make sure you know everything there is to know about the chances of success in any industry before you jump in.

Good luck! 🙌