The definition of financial distress is a company that cannot generate sufficient income to meet its financial obligations. This situation can sometimes happen very quickly but generally, rather like a reality TV series, the business and people within it are on a journey, albeit in this case a trip that no one wants to be on. For, when a business becomes distressed without a successful turnaround strategy, everyone gets fired.

We’ll take a look at three main factors that cause businesses to become distressed… because if you can recognize any similarities to your own business, it may help you spot emerging problems. Or, if you are already in a distressed situation, understanding how you’ve got there is an important part of finding the answer of what to do next.

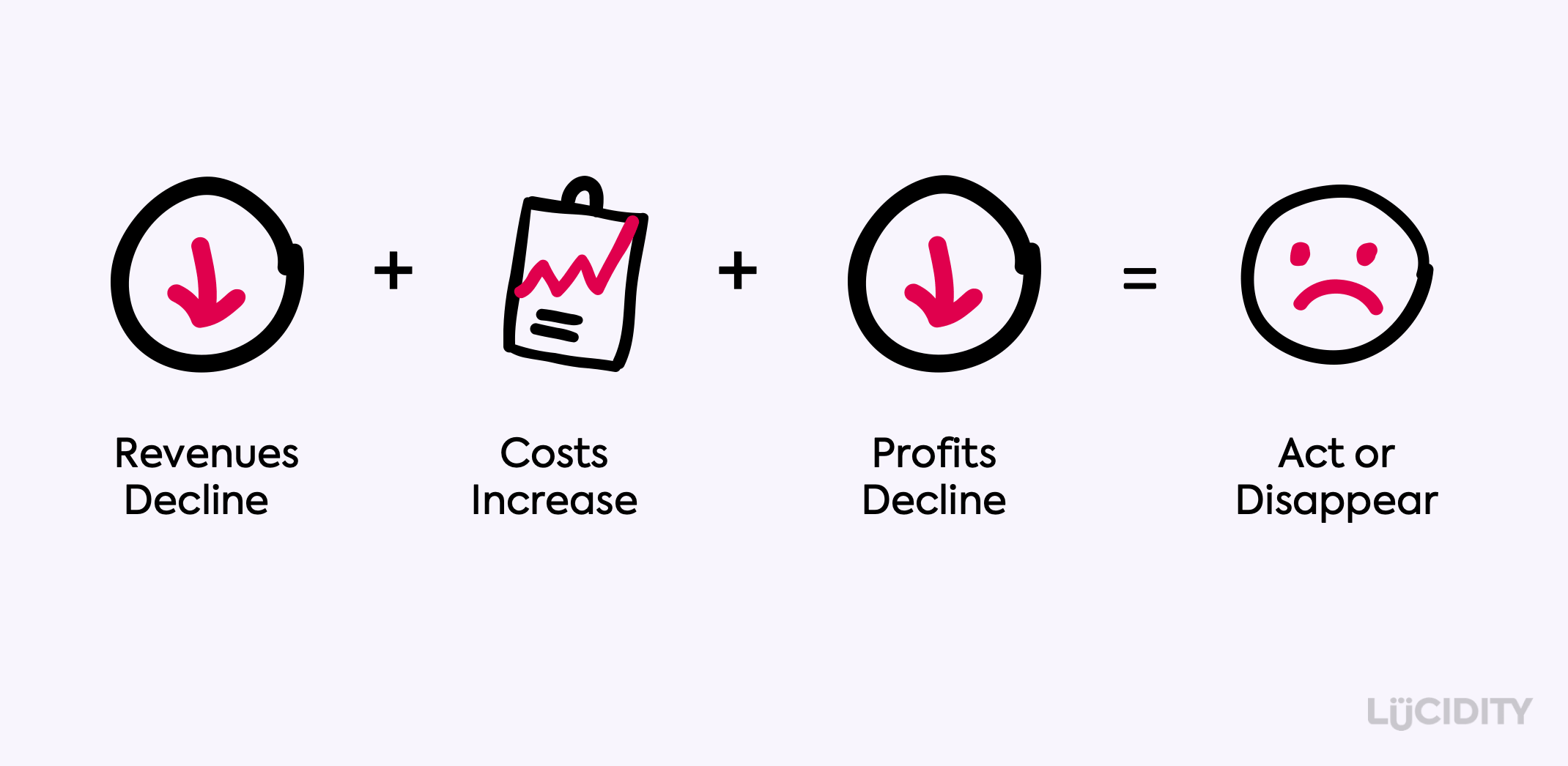

There’s a pretty simple equation around distress which looks like the image below, the sort of maths that everyone can deal with.

Revenues decline, costs are too high and/or increase which inevitably leads to a decline in profits and the business entering loss making territory. The team and organization are then faced with the simple choice of acting or disappearing. The additional dimension to all of this is time; whether this process is a relatively fast experience or drawn out over a longer period.

So what are the most common reasons and drivers for businesses and teams finding themselves in this situation? We’ll look at three:

Drifting Off Course

Remarkably, many small to medium sized businesses don’t have a clear growth strategy. It’s unsurprising that without a clear strategy – a vision, objectives, a revenue model – it’s very easy for a business to drift off course.

Common behaviours for businesses without a strategy are trying to do too much, focusing on the wrong things, or simply failing to do what they are supposed to be doing. This all leads to a failure to deliver results.

Anecdotally, we think drifting off course is by far the most common reason that causes turnaround situations and is arguably the easiest to fix – by having a clear strategy and sticking to it.

Drifting off course catches a lot of businesses out because it’s gradual. It’s hard to recognize until it’s too late and it can be caused by a plethora of small reasons within the business that combine to dramatic effect.

Common reasons that contribute to this drifting include:

No Strategy

If you don’t know where you’re going, you’re not going to get there.

Failing To Execute

The gap between the plan and the execution costs businesses billions and billions each year.

Lack Of Focus On Results

At the end of the day, someone must deliver financial results and this simple loss of fact or focus is remarkably common.

Cultural Issues Around Results

Sometimes a culture either of underachieving or unprofessionalism can try to override the business law of gravity, leading to many unhappy faces.

Poor Leadership & Management

Leaders failing to ensure there’s a plan in the first place and Management failing to execute it successfully.

Poor Departmental Performance

Lots of variation in this one. It could be sales not bringing in the numbers, marketing not delivering a return, finance restricting investment in growth, service or product having quality issues, HR not developing or engaging talent, technology not providing the right infrastructure, etc. Every team can do its bit to help things drift off course, underperform or never quite happen.

Increased Competition

If drifting off course is largely self-inflicted, an increase in competition is arguably much more of an external issue. The scary thing with competition, in contrast to slowly drifting off course, is the speed at which a business can come under threat by a sudden and/or surprising competitive move.

A board brush example here that probably most people can recognize is the behaviour of Amazon over the last few years. Most boardrooms, large and small, have watched in fear as Amazon chooses to enter a market or sector. Their rampage from online book retailer, to everything retailer, to web infrastructure, to music, to film, to healthcare, to grocery to gaming. They even now own James Bond.

You’ve suddenly gone from being quietly chuffed with your market share, to sitting next to an 800lb gorilla who’s staring you in the eye.

Of course, your new competitor doesn’t have to be big. In the software industry, there isn’t a CEO that doesn’t worry about the kid in the bedroom with a laptop who comes up with some code that replaces them within a matter of weeks. That’s one reason threat of substitution and new entry sit so highly in Porter’s Five Forces.

Let’s look at the different types of competitive activity that can ruin your cornflakes whilst reading the news in the morning.

Brand New Entrant

This is the kid in the bedroom, or the new technology from the other side of the world that arrives, putting you under unexpected pressure. Look at Unilever losing market share to Dollar Shave Club and having to buy them for $1billion to regain market control.

Sector Entrant

As touched on above, the repeat offender here is Amazon. Did the big hosting infrastructure companies see an online bookseller becoming their biggest competitor and AWS taking massive market share? No, they did not. Who has the skills, capability and people to step into your market with a fresh approach?

Product Extension

Increases in competitive activity can come from indirect or tangential competitors who amend their product to put their tank on your lawn. Not quite a tank but let’s consider Hummer which was a stripped-down military vehicle acquired by General Motors who made it more comfortable and created increased competition for the other SUV manufacturers such as Jeep.

Technology Change or Innovation

Let’s go with an example we can probably all relate to – AirBnB. The well-known story of the spare air bed being rented out during a busy city conference season spawned significant competition to hotel operators globally. The list of casualties in this category is long – Kodak, Blockbuster, Nokia, Xerox, JC Penney/Sears/Macys, Borders, Motorola etc.

Pricing Strategy / Price Wars

Increasing competitive pressure on a rival through pricing is a very common strategy and tactic. For many examples of this look into the B2C sectors – low cost airlines, telecommunications/mobile providers, supermarkets, particularly supermarkets selling petrol.

In these sectors competing for the attention and spend of cost-conscious consumers is a daily battle. To win, you need to have chosen a cost focused strategy in the first place and therefore structured and organized your business to compete on price. To compete on price without that strategic intent is dangerous.

There is a vicious circle here that goes back to the start of this article as distress is “a company that cannot generate sufficient income to meet its financial obligations”. Cutting your prices without the strategic intent gets you into loss making territory fast. This is also particularly dangerous for a small business as without scale, you are better off competing by differentiating or focusing on a niche.

Decline In Demand

The third and last area we will look at that causes distress and the need to turnaround is the decline in demand for products or services the company provides. This ultimately leads to reduced sales, reduced profits and an increase in sad faces.

This is sometimes caused by the combination of drifting off course and increased competition, but we’ll look in this section at some specific aspects of business that cause a decline in demand.

What causes a decline in demand for your products?

Legal & Regulatory Change

External factors such as legal & regulatory change can cause a big and instant decline in demand for products. Think Consumer law, Health and Safety law, Import/Export law, Environmental law. For example, has the “Sugar Tax” impacted sales of sugary drinks?

Societal Change

Societies change their opinions. Sometimes this happens as a result of legal changes and sometimes legal changes happen as a result of societies changing their views over time. Consider diesel engines and vehicles. Anyone involved in diesel engines; sales, maintenance and their supply chains, will see a decline in demand for those services in the coming years as (environmental) laws change and consumer demand changes with them.

Substitution/Buyer Needs Change

This could have been placed into the Increased Competition section but we wanted to treat it differently as it’s often the cause of demand decline. Substitution occurs when a product comes along and replaces another product. Think the iPhone and Cameras. Actually, think the iPhone and a lot of things – pocket torches, compasses, calculators.

Another more nuanced example of substitution is the introduction of text messaging in the 1990s. Nestle, the chocolate manufacturer, saw a decline in demand for chocolate as children were spending their pocket money on SMS messages and ringtones.

Substitution and changing buying needs are slightly more complex than an increase in direct competition. These are indirect factors, they may not be immediately obvious or identifiable and wider supply chains are affected, not just individual products.

Reputational Problems

With the prevalence of online reviews for anything and everything 24/7/365, the possibility of reputational damage is higher than ever for brands. If poor reviews or customer experiences for your business are achieving a Google ranking that your main marketing site cannot, you’ve got a problem and you’re going to see a decline in demand for your services or products because of that.

Summary

The business law of gravity can’t be ignored. Businesses have to generate enough income to meet their financial obligations.

As you can see there are a plethora of reasons within the business and outside the business that affect results. Whether this is a slow decline or a sudden event depends on a number of factors.

Whichever the case, the team has to act and put in place a successful turnaround strategy if many sad faces are to be avoided.

If you need to turnaround, we can show you how

Book a demo of our strategy software and we'll show you our step-by-step process for building a turnaround strategy and getting back to growth.