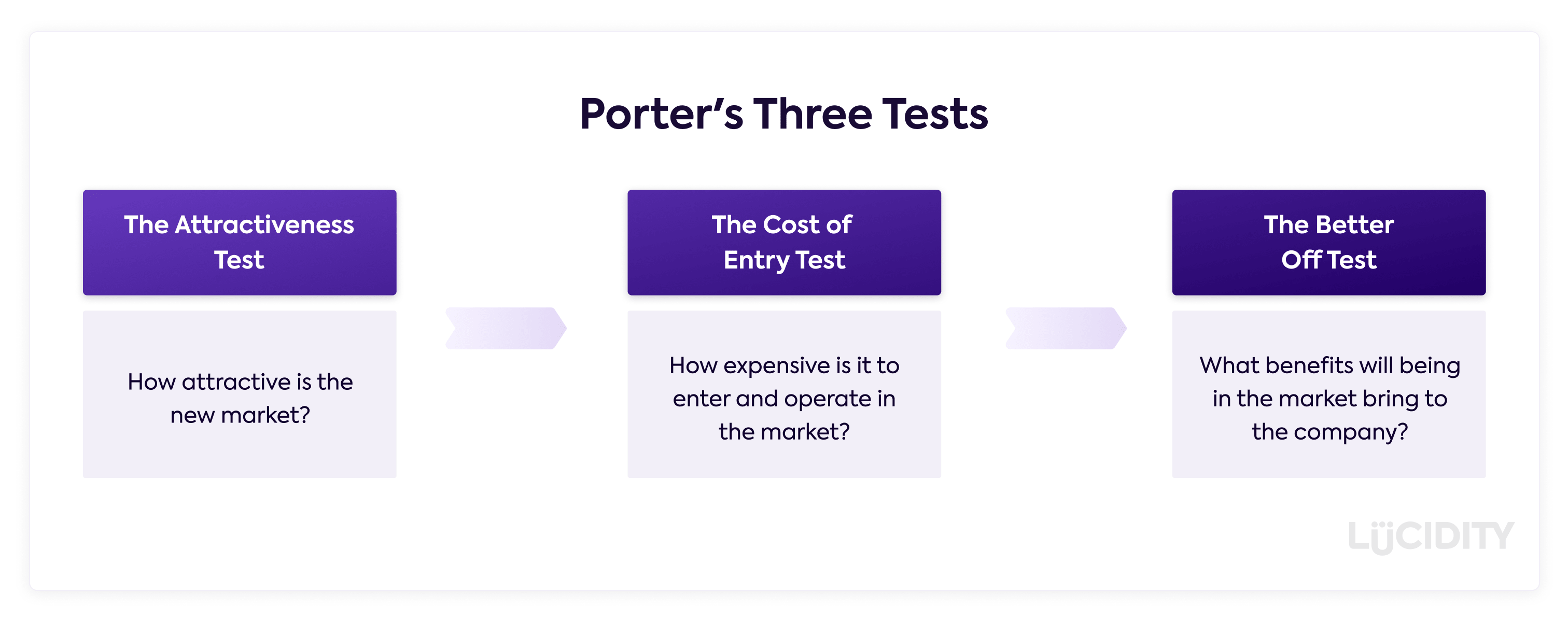

Porter’s Three Tests are checks that you can do to ensure your diversification strategy is likely to succeed in creating value for the business.

Let’s take a look in more detail…

What are Porter’s Three Tests?

Michael Porter devised three tests for a company to perform in order to validate if diversification will be successful in creating shareholder value.

The three tests are:

- The Attractiveness Test: How attractive is the new market?

- The Cost of Entry Test: How expensive is it to enter the market?

- The Better Off Test: How will the company be in a better position?

If your diversification cannot pass the above tests then you should consider if it is a viable strategy that will help your business.

What is The Attractiveness Test?

The Attractiveness Test addresses if the new market is appealing for the company to enter in the first place.

It’s an important question because diversification is only capable of generating value for the business if the new market being entered is capable of generating revenues greater than the cost of entering.

Ideally, diversification should give you the capability of generating greater revenues than your current market opportunity.

Some considerations about attractive markets:

- They not need to be at peak growth in order to be attractive to enter

- There are benefits in entering a market early on in the lifecycle

- They do need to be able to support long term, viable growth for your business

- Attractive does not mean there is necessarily a low cost of entry

- Attractive does not mean there is necessarily similarities between it and your current market

What is the Cost of Entry Test

The Cost of Entry Test evaluates if the potential profitability of the market is greater or lower than the cost of entering. If it’s lower, then you shouldn’t be looking to enter the market.

This test requires some research into your new market in order to establish all the costs you’d incur from operating the new venture. Consider the existing competitors, who already have scale and experience, and how much you’d spend when you compete against them.

If you’re unsure then a MVP or proof of concept test might be a way to minimise the cost of entry while gathering enough feedback to decide if it’s worth aggressively going for the new market.

Some considerations about cost of entry:

- You could acquire a business or unit rather than create a new product or service

- You should be using other tools such as Five Forces in an attempt to understand the market

- Make sure you evaluate competitor activity from their team sizes (use LinkedIn) to their published accounts and news

What is the Better Off Test?

The Better Off Test looks to establish if the company or new unit will be better off from the diversification and thus gain some form of competitive advantage. In order to pass the test, there has to be some tangible benefit to either the existing company, acquired company, or new business unit.

The benefit could come in many forms, such as increased capabilities or access to new market channels, but to be successful in the long term this has to be in place.

Some considerations for the Better Off Test:

- Benefits should be ongoing rather than one off

- Look across your business operations to evaluate each one against the diversification

- Ensure you have the right skills in the business to implement the wins of diversification

- Evaluate the Better Off test after diversification has happened to ensure you are achieving all the benefits

What are the advantages of Porter’s Three Tests?

The advantages to using Porter’s Three Tests include:

- A higher chance of diversification success

- They are simple tests to challenge thinking

- They can be split up and allocated to specialists on the team

- They are mutually exclusive and if done sequentially can save time on ideas that won’t work

What are the disadvantages of Porter’s Three Tests?

Some disadvantages to the Porter’s Three Tests include:

- It requires other frameworks to evaluate the marketplace

- It is subjective to answer some of the questions

- There is an element of ambiguity in two of the three tests

What tools should be used with Porter’s Three Tests?

Porter’s Three Tests work well when used in conjunction with other frameworks. Porter’s Five Forces or the Six Forces model are a great way to establish attractiveness by looking at the dynamics within the potential market, whilst the Ansoff Matrix is a commonly used tool when looking at diversification in general. Finally, read through Porter’s Generic Strategies to establish alternative options to diversification.

Who invented Porter’s Three Tests?

Michael Porter developed the three tests for successful diversification in 1987, in “From Competitive Advantage to Corporate Strategy”. He’s the same Michael Porter who developed Five Forces, Generics Strategies and Four Corner Analysis. He’s responsible for a lot of thinking in strategy!