In times of big change, you need to develop a strategy for your business not only to mitigate the impact of crisis, but also to make the most of opportunity – not just the online world and remote working, but the potentially significant reconfiguring of the economy that emerges.

Typically, a business leadership team all have different ideas on how to do this. Some are more bullish, proposing ventures into promising unchartered territory. Others are more cautious, urging that “we stick to what we know”.

The right strategy needs to accommodate the ideas and risk appetite of the whole team, and engage them to enable effective implementation of it. This can get problematic, and is often why strategy development gets stuck.

One way to unlock this is for the team to play Ansoff Roulette.

Ansoff Roulette

Strategic decisions in many cases involve evaluating the trade-off between an expected profitability from a chosen path, and the risk associated with that path. A good way to see this is to use a workshop tool that I invented and have used with client senior management: Ansoff Roulette.

One of the most visual displays of quantifiable risk is the roulette table. If you place your bets in one of the big boxes, the red or the black, the odds or the evens, the risk otherwise expressed as the odds, are low. There is almost a 50% chance that you will win.

The return reflects this – you can only double your bet in winnings. If you place your bet on a smaller single number square, your risk is much higher. You have slightly less than 1 in 36 chance of winning. But if you win, you get 36 times your bet.

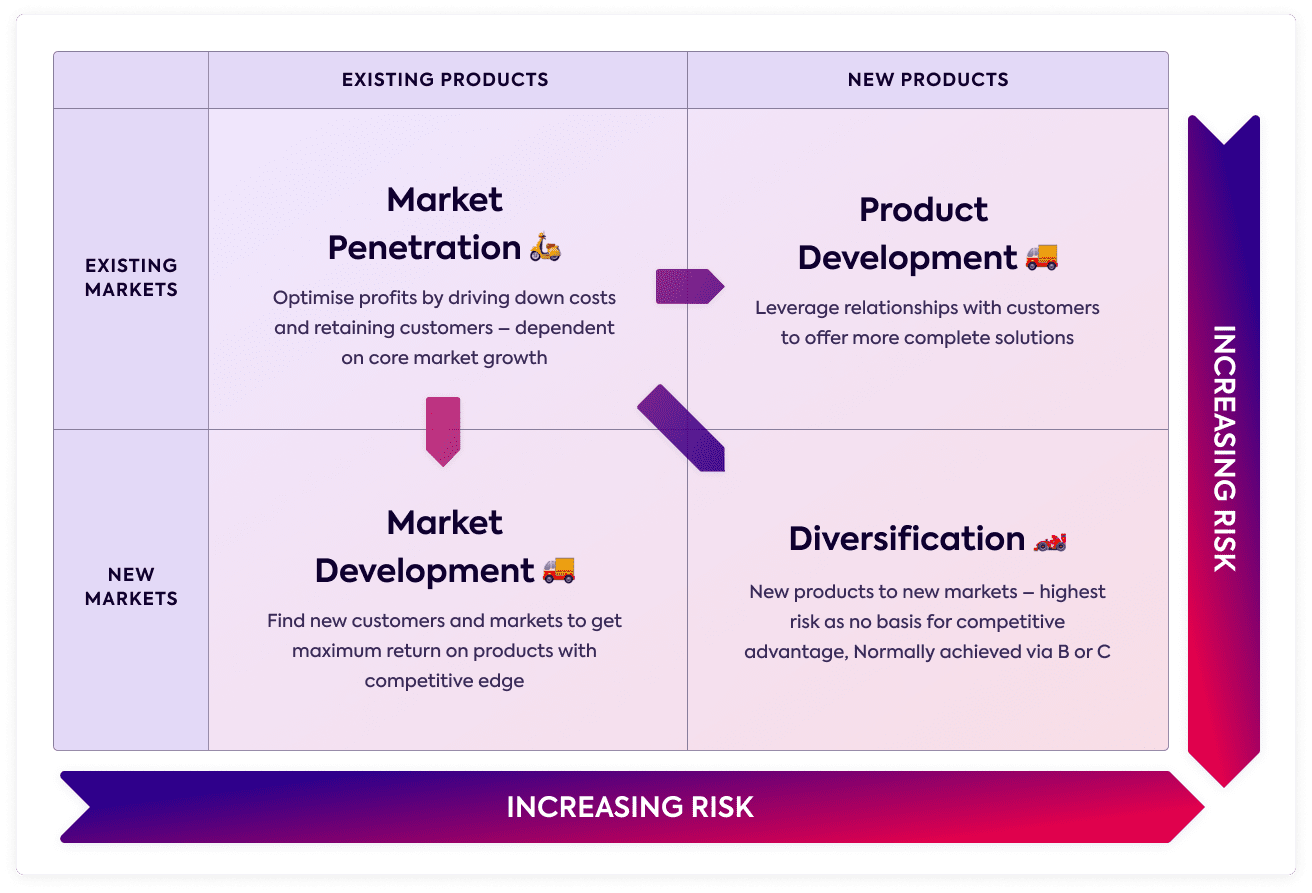

At the same time, one of the more visual ways of thinking about business strategic decisions, under competitive conditions, is the Ansoff Matrix. Igor Ansoff in his book Corporate Strategy, written in the 1960s, proposed a diagram as a way of systematically considering strategic growth options, based on either of developing new products for existing customers/markets, or finding new customers/markets for existing products, or completely diversifying into new products for new customers/markets.

Clearly the growth opportunities from venturing into new products and/or new markets must be significantly greater than from sticking in the current zones, so if growth were the only consideration, you would place all your bets in the new boxes.

But there is a catch – increased risk. Why increased risk? There is an instinctive sense that when we work with products we already know well, in markets we already know or more to the point are already known, the likelihood of our suddenly finding ourselves losing our shirts is much lower than if we are moving into unfamiliar areas. And this appears to be generally borne out by experience.

However, we must ask what is the real nature of the risk of going new instead of current. The essence of it is that we know less – we have less information about the new and what happens when we operate in that area. We can estimate how we think we will do in the new – forecast expected sales or profit – but the likelihood of our being right is much lower. The degree of variability of possible outcomes is much higher – in this sense, the risk is higher. But so too is the potential reward.

Playing The Game

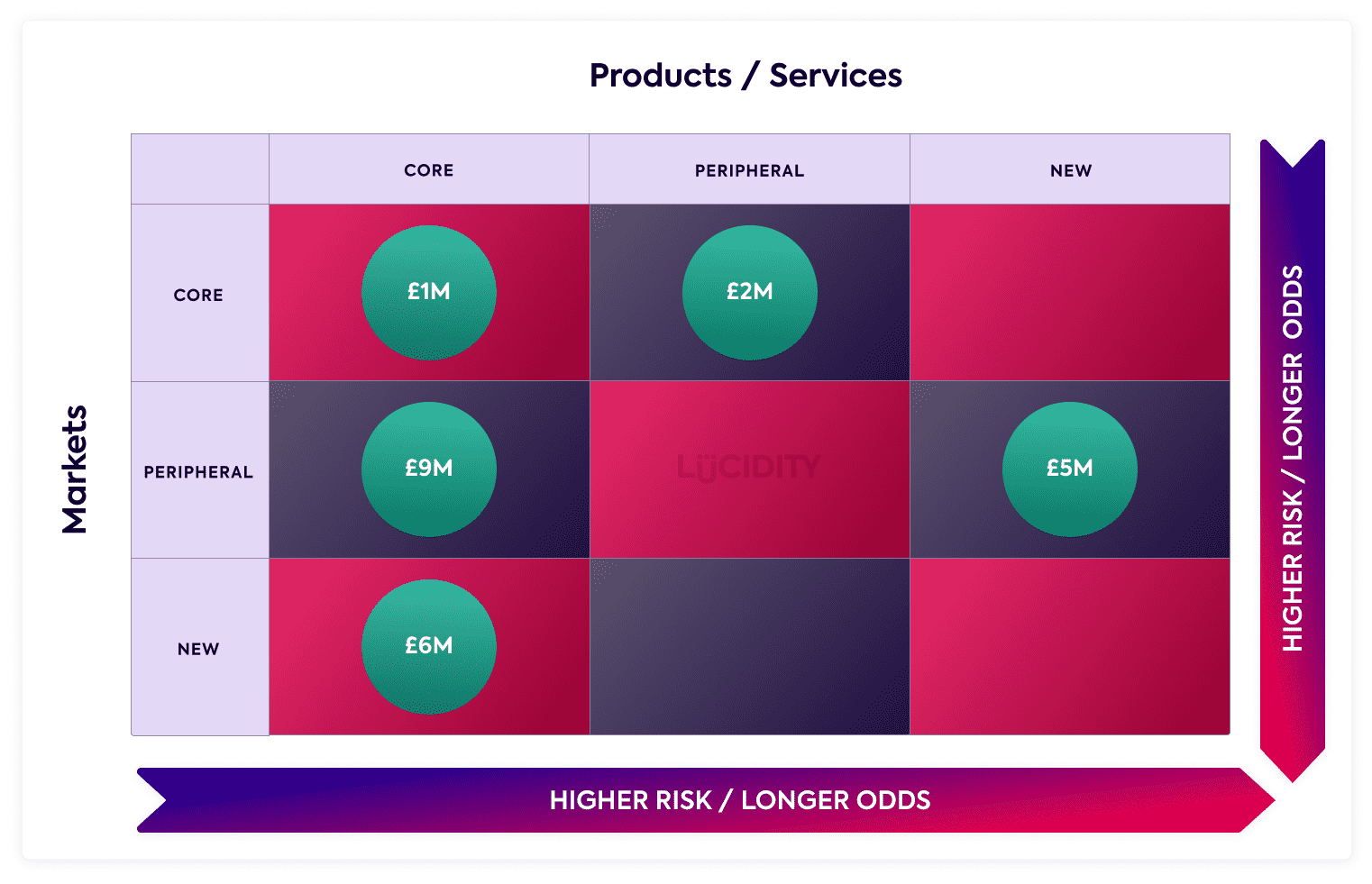

When I used Ansoff as a framework in a strategic workshop with a client, we called the process Ansoff Roulette. We spent a lot of the workshop reviewing different projects which offered growth opportunities.

We then drew up an Ansoff Roulette table (as shown in the diagram above) and decided where we would place each of the projects on the table. To what extent were we looking at launching new products, and in some cases straying into new product technology? To what extent were we proposing to operate in new markets – either new geographical markets, or new sectors, or even new channels or decision makers within existing sectors?

Then each member of the team had a certain number of chips, representing their votes on how to invest the limited growth funds available. We ended up with a set of strategic priorities with which everyone felt comfortable.

There was an interesting point in the meeting when I pointed out to the team that the further their project strayed from the top-left quadrant – the current product/current market quadrant – the more risk they were taking on.

There were heated protests from those who had proposed the more adventurous projects. That was until I pointed out that, just like a roulette table, while the odds of winnings may be longer, the potential winnings were also higher to compensate. This led to a new level of enthusiasm in approaching the exercise, and some robust and useful discussion.

We see in this situation a good example of how perception of what we mean by “risk” can have a significant influence on the process for making strategic decisions. If we see “risk” primarily as increased danger and a higher likelihood of experiencing harm, we are less inclined to vote for a strategic option which carries more risk. If we see “risk” as increased variability of possible outcome, with as much upside as downside potential around our estimated outcome, then we become more likely to vote for the riskier option. If at the same time, we add that the expected outcome from the riskier option is better than the expected outcome from the less risky option, we are even more likely again to place our bets on the “new-new” strategic options.

This Ansoff Roulette model worked well for this client, who has since had a high degree of success in implementing the strategy.

Summary

Ansoff Roulette features in my book, “Risky Strategy” (Bloomsbury-2016), which is based on my experience as a strategy consultant for many years, and on research I conducted with colleagues at Hult Ashridge Executive Education dealing with the issue of “how leaders work with risk”. This research was triggered by the observation that as a business school, we were running risk classes, covering how to “drive out risk”, and classes on leadership which included “how to take risk”. There seemed to be a contradiction.

I learned from the research that effective leaders not only need to be effective strategists, and also need to understand the nature of risk. The essence of strategy is in choosing the right risks to take. This is as much an art as a science. It’s about balancing an analytical and an intuitive approach. It’s about being selective about information, and how we understand variability. It’s about being aware of mind games and seeking to avoid psychological traps. It’s about character and how that influences risk taking – it is about how organisations manifest and develop that character. Strategic leadership is about being deliberately choiceful about risk. There is a need to get the right balance between the virtues of courage and prudence, to sail the middle ground between the Scylla of recklessness and the Charybdis of cowardice … to take the right risk.

The Author

Jamie MacAlister (jamie@blonay.co.uk or +44-7710-397824), is a Professor of Practice, lecturing in Strategy & Leadership and an accredited executive coach at Hult Ashridge Executive Education, Civil Service Learning and the School of Business & Applied Technology (SoBAT) at Clarke International University in Kampala, Uganda, which he was involved in setting up in 2017. He specialises in Strategic Pioneering and has published a business book entitled: “Risky Strategy: Understanding Risk to Improve Strategic Decisions” (Bloomsbury – 2016: www.riskystrategy.co.uk ) based on Hult Ashridge research on how leaders work with risk and on a personal exploration of the role of faith in business.

He was previously Commercial Director at Ashridge Executive Education and prior to that, was a strategy consultant for 21 years, (12 of those with PwC). He has founded and run three small businesses, all still operating, and has set up a business in Uganda to export/market consumer products based on tropical health plants. He has an MA Engineering from Cambridge University and MBA (Honours) from Wharton Business School.