The sliced bread market is still largely dominated by industrialised products. These industrial companies are under threat due to consumer tastes for these industrially produced products fading, with consumption of bread products from small artisan bakeries proliferating.

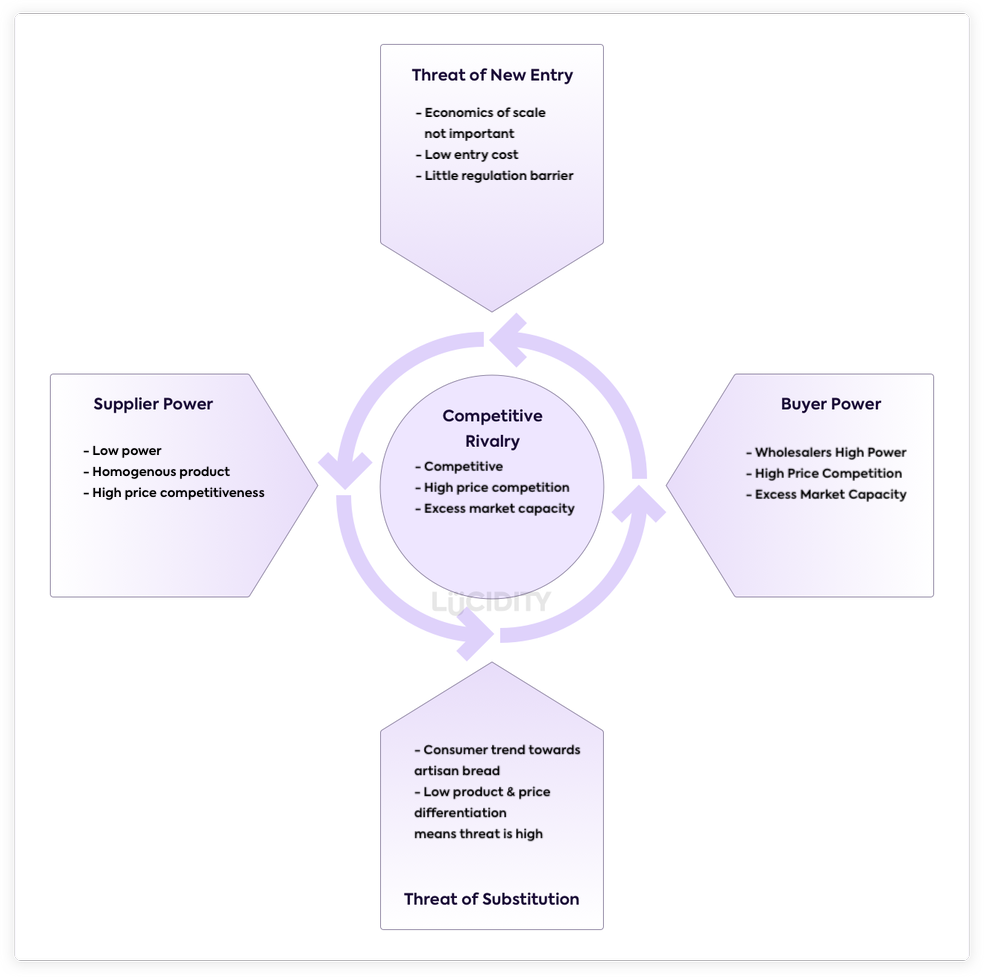

To understand the industry’s attractiveness and profitability a Five Forces industry analysis has been carried out. This will be focussing on the sliced and wrapped bread category as defined by the Federation of Bakers. The industry boundary is defined in this way because the entire industry has a vast range of product segments. It allows the comparison of sliced bread to other baked goods and how they could act as a threat to the sliced bread market.

Threat of Substitution

The threat of substitution for sliced and wrapped bread is fairly high. Large numbers of small artisan bakeries with differentiated products pose a large threat to industrial sliced bread manufacturers.

Small bakeries also have a number of advantages over the larger players:

- They are better placed to take advantage on the market trends of alternative baked snacks replacing wrapped bread, due to the nature of the larger producers standardised, homogenous supply lines.

- They can quickly bring to market products in the health and fitness space as consumers are looking to buy lower calorie alternatives to sliced bread.

- There are no heavy fixed costs or need for heavy investment in economies of scale to produce baked goods.

- This absence of legal and regulatory expenses make this category an attractive one for small bakeries to enter.

- Small bakeries an absolute cost advantage, as they do not have to pay to fuel expensive production and distribution lines.

Wholesaler Buyer Power

In terms of buyers, wholesalers are the interesting parties. Whilst the ratio of buyer to provider is fairly even, sliced bread is a commoditised product that does not make up a large portion of wholesaler’s expenditure, giving buyers power. With high market concentration, price competition in the bread market is high, with low product differentiation, giving buyers propensity to substitute and drive prices down.

Market analysis shows that price wars between supermarkets have pushed down prices of bread. Wholesalers also often have the capacity to produce their own brands of bread, pushing up price competitiveness even further. This is a form of backward integration.

Raw Material Supplier Power

The raw agricultural products required for bread are largely homogenous (wheat, barley etc) and companies struggle to differentiate their product. Furthermore, there are a large amount of these suppliers to a well-developed sector meaning customers have low switching barriers, giving suppliers little power.

The only situation where suppliers might increase prices is due to natural conditions such as weather, which will affect their yield and force them to increase prices to cover their own costs.

Highly Competitive

Due to high market concentration the sector is incredibly competitive. Firms produce homogenous products and their main aim is to minimise prices, making price competition strong. There is also an excess of market capacity, meaning firms must remain fiercely competitive to stay afloat in the market.

At present, the industry may be an attractive and profitable industry to enter for small-scale bakeries. Industrially produced products still dominate the market, meaning to gain a similar market share to these large, high investment in production technology is required. However, if this consumer trend continues and large industrial companies fail to innovate, smaller companies with more diverse product ranges could, one day, be new market leaders.

Complete your own Five Forces here.

The Future of Bread

Warburtons Director, Ross Warburton, points out that consumers are frequently exposed to new countries and products and want something other than sliced bread. Building on this, statistics show that in the past year, demand for not just sliced bread but all staple foods, has decreased suggesting that consumer tastes are becoming more sophisticated and “staple food” providers must innovate to stay competitive.

Warburtons have invested in innovative products whilst other groups are failing. The most successful of these products is the new low calorie “Thins”, contributing 10% to their overall sales. The Thins can be easily incorporated to the industrial scale production, which cannot be replicated by small bakeries, as they do not have the facilities to produce this product in bulk, reducing threat of rivalry. Furthermore, as a new and innovative product specific to Warburtons, unlike sliced bread, consumers are not on the look out for higher quality artisan versions, making the threat of artisan substitution much lower than that of traditional sliced bread.

Warburtons have employed Neil Campbell, a specialist in making companies stand out with experience in Tropicana and Walkers, as chief executive to help distinguish themselves in the market.

The strategy being used is called the “Differentiation Strategy”, based on Porter’s Generic Strategies. It involves a company differentiating their product from that of their rivals in order to boost sales.

Warburtons can produce and deliver the product to 18,000 outlets daily, allowing them to control the handling and quality of the product right up to the shelf. This level of speed and consistency makes them favourable over other brands to wholesalers, further reducing threat of rivalry.

To achieve greater profitability, Warburtons should consider acquiring smaller high-street bakeries. This way they can use the consumer trend of non-industrial baked goods to their advantage rather than disadvantage.

Warburtons can use their financial power to maximise efficiency by improving the bakeries’ operational and production capabilities whilst retaining the bakeries’ artisan, individualistic brand. This strategy will increase profitability and reduce the threat of competition and substitutes from smaller bakeries.

If Warburtons can acquire popular bakeries with strong brand identities, they can help these brands grow and gain more market share. This strategy has proved effective for other companies in the food and drink sector such as SAB Miller

Market research shows that consumers are eating lunch at home far less than they used to. Consumer taste in sliced-bread based homemade lunches has fallen.

Warburtons could consider stretching their capabilities by further diversifying their product range to the take-out lunch market by producing readymade sandwiches. This will introduce Warburtons to a whole new market segment, rectifying the issue of loss of sliced bread sales by increasing profitability through a new market.

This strategy coexists well with the previous potential strategy mentioned as the high-street bakeries acquired by Warburtons can distribute the sandwiches.

The Warburtons Advantage

Warburtons have valuable tangible and intangible resources. Their industrial production resources have high market value and play a huge part in making Warburtons products cheap to produce and pushing down prices, which is of huge value to wholesalers. They also enable Warburtons to produce alternative products such as “Thins”, which plays a great part in Warburtons’ differentiation strategy, a key contributor to Warburtons’ competitive advantage.

They also have a strong brand identity, helping to build customer loyalty and defend against rivalry. The brand also helps them to differentiate themselves from other companies and adds perceived value to their products.

In this crowded market, it is likely that only the few market leaders have production capabilities similar to Warburtons. This would usually lead to competitive party, where firms use similar resources to implement the same low cost strategy. However, Warburtons have coupled the low-cost strategy with differentiation strategy, making them market leaders. Their brand is also a rare resource. It is only possessed by Warburtons and cannot be used by another company.

Although the production resources are expensive, they are imitable if the company becomes able to afford them. However, Warburtons’ competency in implementing these assets helps them sustain a competitive advantage, for example with their ability to deliver Thins to 18,000 a day. This is not easily imitated.

Warburton’s brand is difficult to imitate for 3 reasons:

- Historical conditions; Warburtons are an old, well established company. This is inimitable.

- Casual ambiguity; it is difficult to identify the particular resources that give the brand value.

- Social complexity; this intangible asset is based off factors that are unique to Warburtons, such as company culture.

Warburtons have invested time and money to ensure resources are organised in a way to capture value. For example, in the last decade, Warburtons have spent 400m on new bakery technology and machinery. “Thins” took 2 years to develop and they are now able to produce and distribute thins extremely expeditiously.

Warburtons can continue to develop external strategic capabilities and grow in the market by using mergers, acquisitions and alliances. Non-core activities can be outsourced, stopped or reduced in cost and training and development can be enhanced. Internal capabilities can be improved by leveraging capabilities an example of this for Warburtons is perhaps applying the production process for sliced loafs to their new “Thins”.

Whilst the industry is changing due to the external pressures of consumer trends and competition, Warburtons are well placed to diversify and innovate to ensure continued success which, in a competitive industry such as this, is vital.

Need help building your own strategy?

Our strategy software makes it faster and easier to formulate a strategy, manage the execution and track the results. Book your personal demo and get a strategy plan template tailored to your organisation.