Strategic cost reduction can be a good thing for your company, regardless of the financial position. It might be to support survival, it might be to stimulate growth, or it may be that your intention is to boost margins. Whatever your objectives, cost reduction should have a place in your strategy.

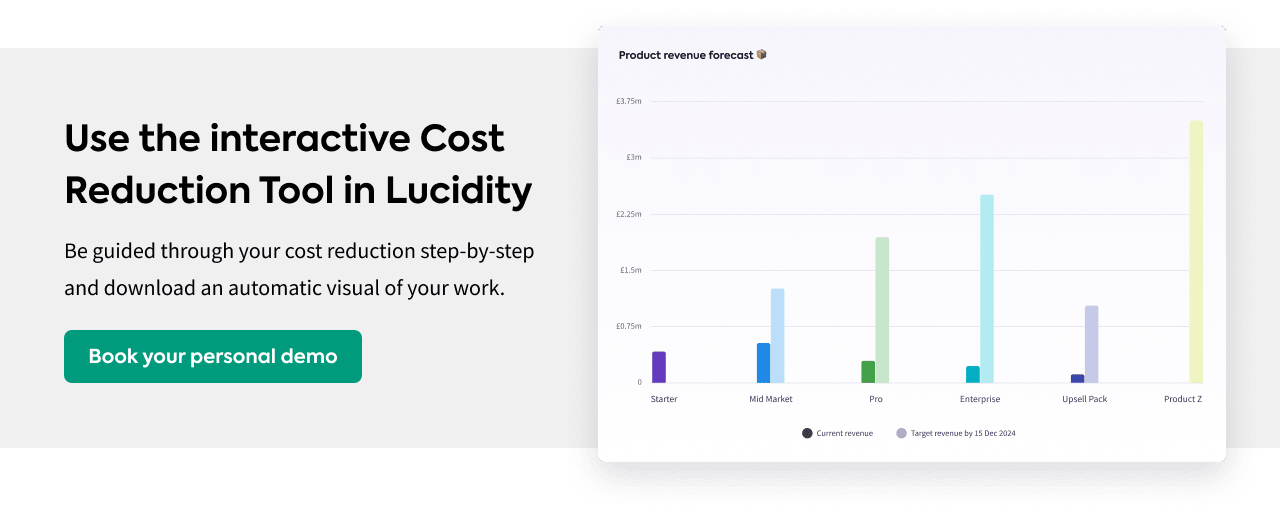

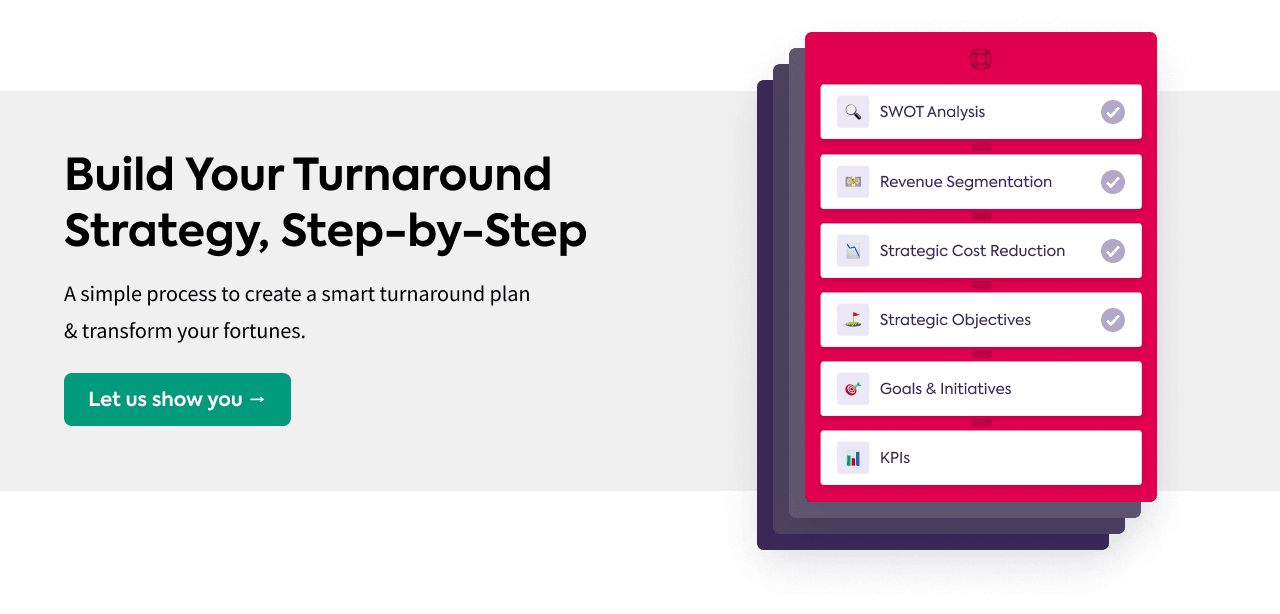

We’ve already provided a guide to strategic cost reduction, a strategic cost reduction checklist, and our strategy software hosts tools to help you.

Now we’re bringing you a curated selection of tips and advice from some excellent CFOs and FDs.

Cost Reduction Tips

"If possible open the cost reduction strategy up to the wider company to gather ideas – get as much input as possible – it’s unlikely a CFO/MD will know everything. Plus it makes it easier to get buy in when all "coffee catch ups" are banned."

Simon Collard, ex-CFO of TMW Unlimited

"Engage suppliers, be firm but fair in any negotiations. If your suppliers are providing key services you need them to share the general reduction in the industry. Push too hard and you will break the chain which damages all. Focus on win win."

Susan Forde, ex-FD of Virgin Holidays

"Consider the short term and medium term impact on cashflow of any strategic cost reduction exercises. Without this extended view, the cost reduction might not deliver what the business seeks to achieve."

René Moolenaar, CFO of Crunch

"Look at peripheral areas of activity – are there service lines where we’re losing money?"

Simon Collard, ex-CFO of TMW Unlimited

"Whilst the costs in the ‘engine room’ room are the easiest to cut because they’re often the largest, reducing spending on costs which drive revenue puts you in to a cash flow/cost saving spiral. In our practice, if we cut staff costs, we would have fewer hours to sell, so would drive down cash flow 2 or 3 months out, so would have to cut cost again. As long as you have the demand, have the supply!!"

Mark Crowter, Partner at Galloways Accounting

"You need control and accountability. Set detailed budgets; hold people to account, if someone needs to go over budget, agree before hand and identify saving elsewhere. Hiring freezes are also an option. They can be beneficial as they force you to focus on what has to be done, but it does come with risk and can have a negative effect on invention. So hiring freezes need to be considered carefully."

Simon Cooke, Group Financial Controller at Hastings Direct

"Think about what the aim of the cost reduction strategy is (survival or sharpening of pencil) and what is the timescale? Do you have transparency on future trading and current financial strength/weakness? I’d then think about whether we could form a tight management team with clear responsibilities to look at various areas; ie marketing spend or property needs or people. Set clear timelines and have regular meetings."

Simon Collard, ex-CFO of TMW Unlimited

"From a strategy planning perspective has the CFO worked with the senior management team to fully define the medium / long-term Business Plan. In doing so, what non-core markets, services, products, geographies and verticals has the team identified that the company is still playing-in. Make sure you expediently work with business partners to decommission those that are non-core to your revenue and profitability growth objectives by attacking all costs in those areas."

Roger Castle, ex-FD of Yahoo! Europe

"Personal one here- take the opportunity to reduce the number of company credit cards."

Simon Collard, ex-CFO of TMW Unlimited

"Ask for price reduction from suppliers. Has volume gone up since last priced? Goods- Can you buy additional products from the same supplier? Services- Is there something you can do in house to make the time cost less? Can we pay shorter terms? Whatever any excuse- the key point is we need to bring this cost down as otherwise we will have to go tender. You want to stay with them, don’t want to do an expensive tender but if we can’t bring cost down hands are tied. A lot of firms will agree to something knowing it will come back in inflation price rises over next few years to avoid a competitive tender."

Simon Cooke, Group Financial Controller at Hastings Direct

"There are a wide range of non-cash alternatives for staff. Cycle to work, more flexible working, share options can all be used to drive engagement without pushing costs. I’m a big fan of share options because they make align the long term interests of owners and the team. Owners can be resistant as no one likes to give away equity, but if you get greater value back through cost saving on salary AND great engagement you can still be up on the deal."

Mark Crowter, Partner at Galloways Accounting

"For an Agency business, there’s no getting away from the fact people are the biggest cost. Hopefully you’ve been running your Agency with some freelance resource which you can flex but if you’ve done your due diligence above it will mean painful choices about headcount at which point we need to think about the size and shape of the Agency we want to be."

Simon Collard, ex-CFO of TMW Unlimited

"I have worked in a few turnarounds and the best advice I got was that if you need to cut cost (mainly people) you should do it once and deeper than you might think. You can always recruit if it leaves gaps. Most businesses also tend to retain people who they think letting go will damage the business (customer relations), even if the person is problematic. My experience is that the ripples are a lot less than people fear."

Ronnie Smith, ex-CFO of Spiritel PLC

"“Understand what impacts P&L and what impacts cashflow. Keep the distinction between the two, that’s really important.”

Roger Castle, ex-FD of Yahoo! Europe

"Think about Must Haves and Nice to Haves (person by person and cost line by cost line)."

Simon Collard, ex-CFO of TMW Unlimited

"Customer prioritization in terms of offering important customers added “perks” can destroy profitability instead of increasing it. Telling customers that they are most important to the firm triggers entitled behaviors that result in an explosion of customer service costs. To maximize the profitability of prioritization programs, focus on benefits that are largely “silent” about customers’ status within the firm and avoid symbolic benefits that make customers feel like VIP."

Professor Maik Hammerschmidt, University of Göttingen

"Review your risk arrangements, for example can you use a hedging programme around exchange rates? Is your insurance comprehensive or up to date, is it more viable to self insure by putting aside a proportion of revenue each month?"

Roger Castle, ex-FD of Yahoo! Europe

"Think about different operating models – some of my clients have cut right back and coming up with a different operating model – pulling in freelancers for specific jobs but not carrying the full time costs. Others are taking the chance to review their basics – rate cards, capacity and some basic financial disciplines. Others are thinking about other service offers or side hustles."

Simon Collard, ex-CFO of TMW Unlimited

Cost Reduction Help

We’ve put together a number of resources to help you with strategic cost reduction including: