Are all your eggs in a one basket? Is your market in decline? Are you struggling to see growth? You may want to consider a diversification strategy. Let’s find out more…

What is diversification?

Diversification is a business development strategy that sees a company enter new markets and offer products and services that are different from its existing ones. That is technically what is meant by diversification, but in reality, there are different degrees that could, arguably, be considered diversification to some extent as we’ll see in this guide.

You can also read more on diversification by looking at the Ansoff Matrix or Porter’s Generic Strategies.for alternative perspectives and insights in diversification analysis.

![How to Improve the Diversification Strategy of Your Business 1 [FREE GUIDE] Learn How to Drive Strategy Formation from Experienced C-Suite Executives](https://no-cache.hubspot.com/cta/default/5961834/d01e9bd4-d9c0-486e-a6e4-1da95f48372b.png)

Why should I consider diversifying my business?

Diversification can be an important component of any company strategy. There are many examples throughout history of successful businesses moving into new areas, such as the iPhone (Apple), Gmail (Google) or Echo (Amazon).

There are different motivations for building and executing a diversification strategy for your business. It is useful to understand which of the following reasons most closely applies to your circumstances.

Growth:

One of the main reasons a business might be looking to diversify is growth. Perhaps your current industry is stagnating or perhaps you are no longer performing well in the market., Whatever the reason, you may find diversification is a great method to support the growth strategy of your company. When you’re considering this as a motive, keep in mind profitability too.

Risk Reduction:

If you put your eggs in different baskets your business will be more resilient. Having a diverse portfolio reduces economic risk by lessening your exposure to market conditions, such as those seen in Five Forces, or external events such as those listed in a PESTLE Analysis. Whilst one business unit may be under strain, others could be performing better than ever.

Survival:

For some companies, diversification is about survival. Their core business is in decline and if they do not move to a new model and market, they won’t survive. In these situations, the diversification is against a challenging backdrop, and ideally, you would recognize the need for diversifying before it becomes impossible to find the investment to do so.

Exploitation of Potential Synergies:

Finally, companies may spot synergies in their processes, operations and assets, and wish to exploit them in other markets

There are many types of diversification. A very popular one is the conglomerate diversification strategy, which focuses on introducing brand new products or services into your supply chain that are not related to your existing business or current market. Essentially, this means entering a new market by expanding your business’ offering or operations.

How do I diversify my business?

There are a number of ways you can diversify your portfolio including:

Internal development:

This is developing the business unit, product, or service entirely in-house with your existing team or hiring new members of the team.

Partnership with other companies:

It may not be possible to invest in building a new product or service in-house, so look for partnerships with other companies to enter new markets and create opportunity for both sides.

Acquisition of another company:

You could acquire a company already operating in the market you wish to enter with the capabilities you want to develop.

There are three key aspects to deciding which approach to go for:

- How long it will take to complete the diversification

- What is the cost implication for the diversification

- What risks are associated to the diversification

Each approach has different considerations to balance. For example, partnerships can be high risk but low cost, whereas acquisition can be high cost but be quick to complete.

What are the different types of diversification?

There are two main types of diversification…

Related Diversification:

Relatedness refers to the potential for sharing resources/capabilities among businesses. That might be Operational Relatedness, which would stem from synergies in manufacturing, marketing, distribution activities and result in cost savings, or it could be

Strategic Relatedness stemming from synergies deriving from the ability to apply common management capabilities to different businesses (e.g. Virgin).

Unrelated Diversification:

Unrelated refers to diversification where the company is entering a completely new market with new products. In these cases, success largely depends on the expertise of the people in the business and their approach to strategic planning.

Companies that perform Related Diversification tend to perform better than those who go for Unrelated Diversification. You could argue that the Unrelated approach may produce higher revenues, as it stems from the idea any company can move into any market, but it is significantly more risky than Related.

The related and unrelated varieties are the most established and commonly used types of diversification. However, there are a few other approaches, such as concentric diversification and horizontal diversification, which should be considered and evaluated when considering this strategy for your organization.

How do I know if diversification will make me successful?

There’s no guaranteed way to confirm the certain success of a particular diversification strategy – diversification is inherently risky – but there are some steps you can take to increase your chances of success.

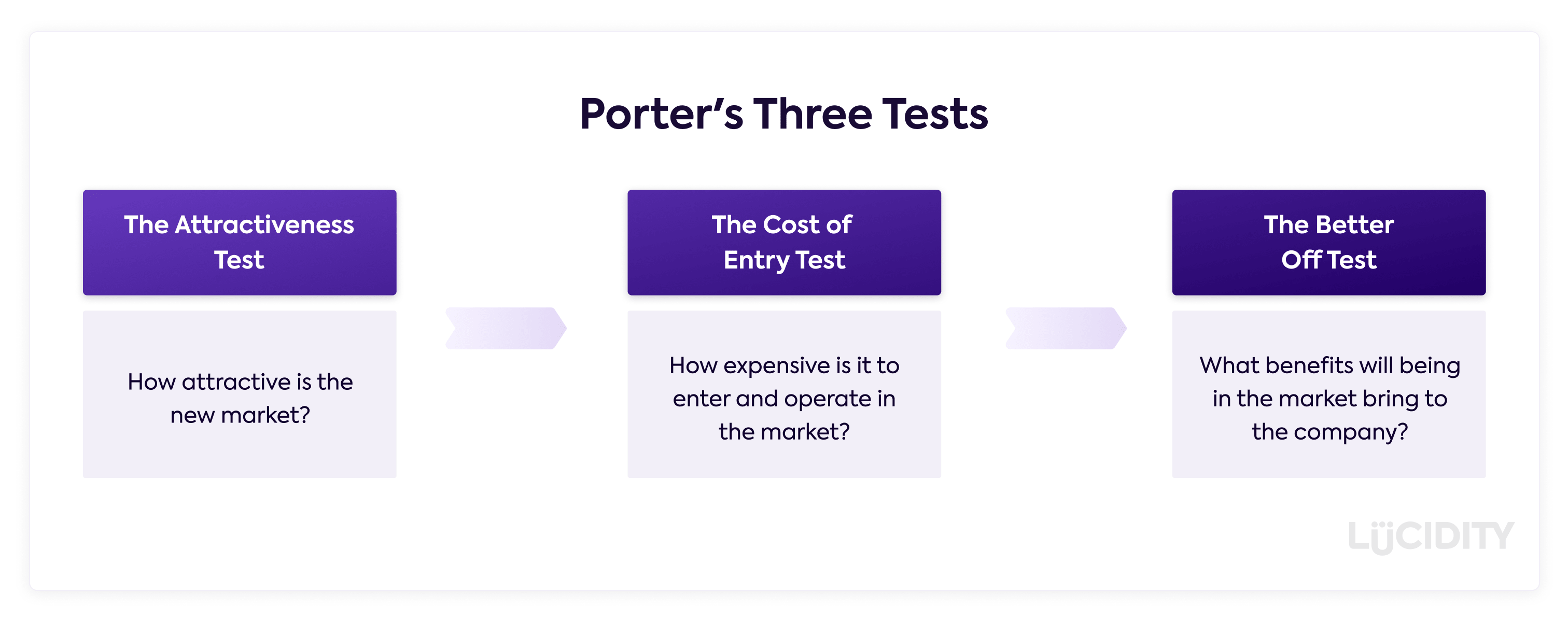

Porter’s Three Tests is a tried and tested model that will allow you to evaluate your chance of success by examining the following things:

So take a look at each of these three tests. Ask the core question for each test and note down your answers. If the three tests have a positive outcome then you have a good chance of succeeding in diversification, if one or more are negative then you are in greater risk of failure.

That was a very brief look at Porter’s Three Tests. For more guidance on how to complete this tool, you can find out more in our Guide to Porter’s Three Tests.

What are the common challenges for diversification?

There are some challenges for diversification including:

- If your business grows and you add a new business or business unit, the cost and complexity of coordination across teams will be higher.

- Lack of expertise and adequate competences to manage the new business

- You may be slower to react to your existing core market and thus suffer loss of market share.

- Similarly to the above, your managerial attention will be distracted by the diversification

- Your core business may suffer unintended consequences by resources being pumped into the new market

![How to Improve the Diversification Strategy of Your Business 1 [FREE GUIDE] Learn How to Drive Strategy Formation from Experienced C-Suite Executives](https://no-cache.hubspot.com/cta/default/5961834/d01e9bd4-d9c0-486e-a6e4-1da95f48372b.png)

What are some examples of successful diversification?

There are so many examples of excellent diversification, including:

- Walt Disney: went from animated movies to theme parks

- Virgin Group: went from music production to travel and financial services

- Fujifilm: went from photographic films to cosmetics & pharmaceuticals

- Johnson and Johnson: develop consumer products, pharmaceuticals, and medical devices

- Apple: went from laptops to mobile phones and music

What are some examples of unsuccessful diversification?

There are thousands of examples of failed diversification, including some really strange ones.

Many great companies eventually diversify in some shape or form, in order to keep ahead of their competition and breach new markets. Applying suitable diversification strategies within your business may be the one factor that your business strategy needs to drive growth. However, approaching and implementing it inappropriately may affect your future profits, so it is key to consider all the information available.

Check out our article on weird diversification for more information!