The French Connection Group (FCG) operates in the fashion industry, offering a broad range of products covering clothing, accessories and homeware. Other products such as toiletries, eyewear and fragrance are licensed under the company’s most important brand, French Connection (FC).

With operations in over 50 countries and over 1,00 stockists, there’s a lot for them to consider. Let’s look at some high level frameworks…

SWOT Analysis for French Connection Group

Strengths

- No debt/borrowings

- High cash reserves

- Brand strength internationally

- Marketing capability

Weaknesses

- Product positioning (pricing hard to justify)

- Online channel is cannibalising offline sales

- Restriction of clothes size options

- Stigma of past FCUK campaign

Opportunities

- Menswear market expected to grow

- 25-34 year old age group is expected to grow

- Scope in terms of product type

- E-commerce channel and partnerships

- Demand for western fashion in emerging economies i.e. India

Threats

- Barriers to exit in the form of store lease commitments

- Weak wage growth means consumers are reluctant to spend

- Cheaper competitors, particularly Primark & ASOS

- Global trade agreements shifting

Read the Ultimate Guide to SWOT Analysis.

PESTLE Analysis for French Connection Group

Political

- Future trade regulations

- Alterations in labour laws and expectations

- Current regulation

- Geographic stability

Economic

- Reduced disposable income of consumers in some core markets

- High rates of unemployment result in better market conditions for cheaper competitors

- Exchange rates will affect the costs FC incurs when exporting and importing products around the world.

Social

- Ageing population which is unfavourable for FC because this is not their target demographic.

- Reduction in number of people shopping in high street

- Attitudes to brands like FCUK and expectations around areas like CSR

Technological

- Integration of virtual and physical shopping experiences

- Sophisticated IT systems allow for more efficient supply chain management and communication

- Monitoring of trends and fashion using social media monitoring systems

- E-commerce is also a popular channel, allowing direct distribution to consumers.

- AR opportunities

Environmental

- Natural resources that are limited in their nature

- Cost of cotton is currently increasing

- Popular attitude towards the environment is centred on sustainability

- Amount of waste produced noticed as is carbon footprint

Legal

- Employment and health & safety regulations

- Consumer protection law allowing for returns – costly in e-commerce

Five Forces Analysis for French Connection Group

Threat of Substitutes – Low to Medium

- There is no substitution for clothing, making rivalry more intense.

- E-commerce is a substitute for traditional retail chains.

Supplier Power – Medium

- Raw materials used in the clothing industry are very similar and many suppliers exist.

- Switching between them takes time and money.

Buyer Power – Medium

- There are plenty of customers in this industry, each making relatively small purchases.

- Brand loyalty is low

- Customers can be very price sensitive.

Threat of Entry – Medium to High

- Only moderate capital requirements prevent new firms entering this industry.

- Attracted by the industry’s profitability and the limited brand loyalty of customers.

- Online only businesses can compete without the real estate previously required

Industry Rivalry – High

- Competitors try to find a niche through differentiation to decrease competition

- Imitation is easy

- Advertising campaigns come at high cost.

- E-commerce also increases availability of products in any location.

Evaluate your own market with Five Forces.

What would you do?

Have a look at Porter’s Generic Strategies as a framework and consider what the options might be for FCG.

For example, one approach could be to pursue a differentiation strategy to increase the attractiveness of their products, given their broad competitive scope and high price point. This strategy is risky because if it fell below expectations the brand image could be damaged. Nevertheless, it is a viable option because it is consistent with the brands edgy reputation for taking marketing risks.

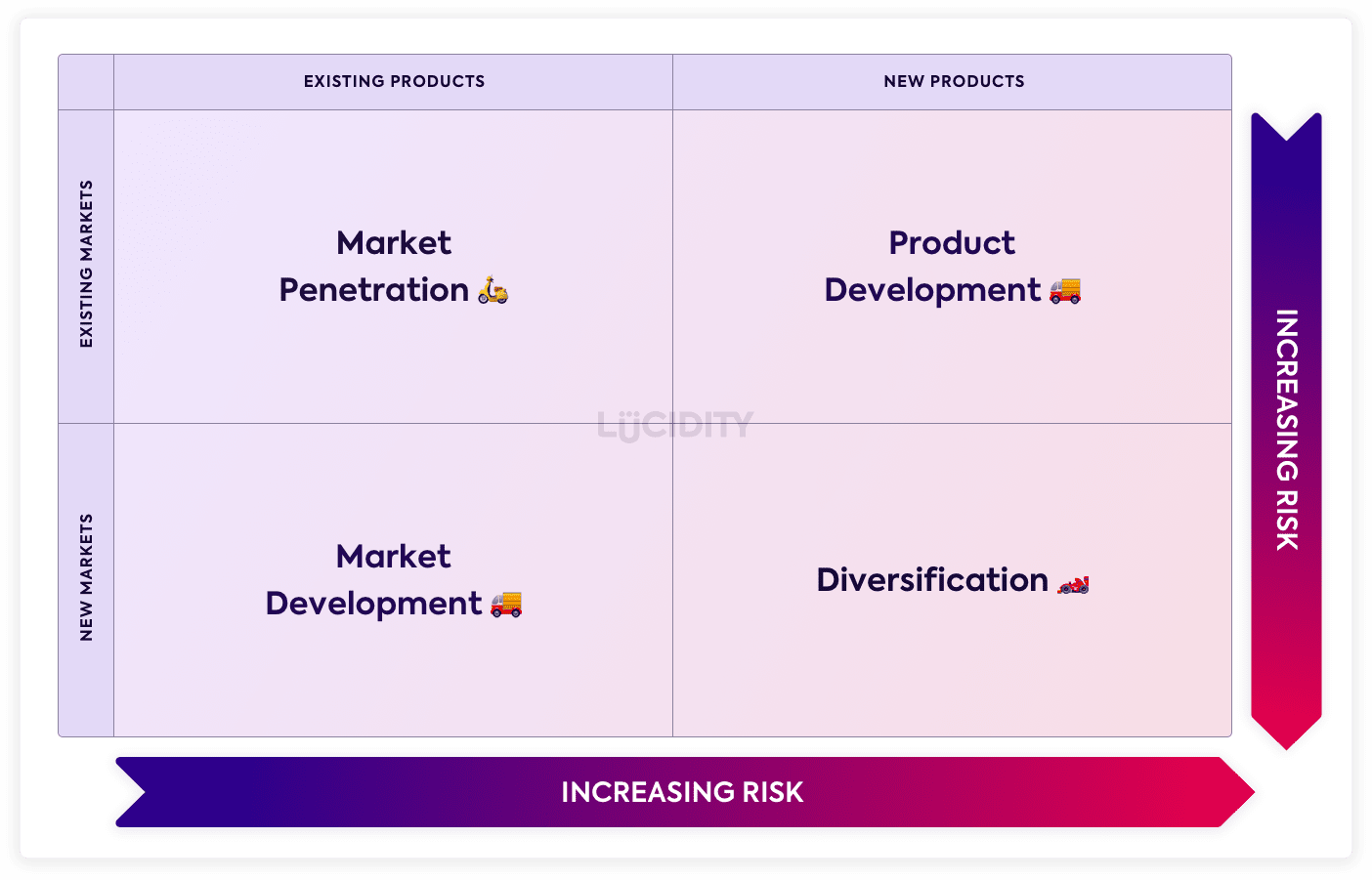

Ansoff Matrix Evaluation

If we refer to the Ansoff Matrix we can evaluate certain options…

- The diversification strategy would help achieve differentiation however it would be reasonably expensive and it fails to address issues with FC’s core products.

- The product development strategy might help to improve desirability and uniqueness of product offerings, despite graduates having little commercial experience.

- The market penetration strategy has its merits in such a competitive industry but implementation may involve offering discounts which contradicts current strategy.

- The market development strategy draws upon FC’s capability and opportunity in the market. Both the financial costs and benefits of pursing this strategy would be great.