The aviation industry has ongoing challenges, especially as we live in a time of increasing environmental awareness.

In this article we’re going to apply a few academic frameworks to easyJet, one of the UK’s best known aviation brands. Let’s look at the current factors which may be considered in their strategic thinking…

SWOT for easyJet

Strengths

- Strong balance-sheet, brand awareness and image

- Environmentally-friendly image

- Innovative data-utilisation

- Solid customer base

- Strong market-sensing capabilities (package-deals)

Weaknesses

- Few routes outside of EU

- Not appealing to business/elderly customers

- Increasingly difficult differentiation on price and convenience (competitors catching up)

- Dependency on partnerships (i.e.: no in-house maintenance)

Opportunities

- Customers increasingly demand for cheap fares

- Full-service airlines might pull back and focus on strictly long-haul

- Short “getaways” market grows significantly

- Diversification (train network) and service development

- Global brand awareness and new routes outside EU

Threats

- Saturated market, intensified competition

- Suppliers (Airbus) have monopoly power over key components

- Political uncertainties, rapid social & technological changes

- Fuel price

- Globalisation

Read the Ultimate Guide to SWOT Analysis.

PESTLE for easyJet

Analysis shows that the greatest challenges are political, economic and legal factors which easyJet has to respond to in the face of political instability, economic and legal uncertainties.

Political

- Brexit negotiators have dropped existing commitments to participate in specific EU regulatory institutions.

- Concerned aerospace and airline industries

- No capabilities in the Civil Aviation Authority to deliver own regulations

- Common Travel Area (CTA): British and Irish can travel freely with access to employment etc.

- Terrorist attacks

- Passengers reluctant to buy tickets in advance (& for after Brexit) due to increased prices and economic uncertainty may lead to less passengers

Despite uncertainty, post-Brexit bookings are booming (ancillary revenue in line with their expectations). easyJet has prepared for Brexit since it has a European unit in Austria (and Austrian air operator’s certificate).

Economic

- Leaving the single market and customs union

- Arrangements will influence UK airline industry

- Government to seek mutually beneficial arrangements for business services

- To minimise discriminatory barriers to establishment, investment and cross- border provision of services

- Uncertainty around future visa requirements, cross- border supply chains and export success

- Increasing fuel costs (airlines going bust)

- Decline in the value of the pound

- Growth in the number of passengers uplifted at UK airports slowed down to +2.9% in 2018 compared to +7.1% in 2016

- Inflation falls to 1.7%,its lowest level for nearly 3 years

- Risk of losing transport connectivity (worse economic relations)

- Restrictions on intra- European flights- airlines may have to decrease the number of intra-EU routes

- Risk of supply chain disruptions

- Slowdown in market growth

- International travel may become less accessible (visa)

- Low inflation supports consumer spending but the price of flight tickets increased which may result in less passengers

- Consumer confidence weakness in the UK

- Foreign exchange movements will have adverse impact on headline profit before tax.

- Revenue per seat at constant currency is expected to decrease.

Social

- High demand for air travel (especially short-getaways) : upward pressure on labour costs (unions calling for better pay and/or work conditions at airports/airlines)

- Increasing societal demand towards sustainability and waste reduction – ‘Extinction Rebellion’

- Social media promotes easy travelling (Instagram, Airbnb)

- Grey market: increased longevity

- Youth market: affluent but world-weary

- Multi-ethnic market: increasing

- Airlines may have to increase wages and find new ways to reduce operating costs

- Increased need to operate greener (see technological)

- Customers reluctant to pay premium price for products/services that do not offer demonstrably greater value

- Customers questioning the extra value

Technology

- New developments around electric aircrafts that take off vertically

- Attempts at developing a new flight design in the shape of a V to reduce fuel needs and to redesign the flight experience

- Currently under development: hybrid aircraft

- Start-up aspiration: full scale commercial air taxi

- Sustainable fuel

- Data-driven approaches to increase profit

- New innovations towards sustainability may drive late- adaptors out of the industry

- Increased importance of profit generation via data analytics

- Better matching demand with supply

- New safety regulations around new innovations

- New means of flying which airlines have to respond to

- Customers think that airlines should prioritise investments into alternative fuels than into electric planes (59% vs 45%)

Legal

- Data Protection

- Cancellation and delayed flights compensation

- Regulation (EU)

- Air passenger duty flying out of the UK (highest aviation tax in the world)

Environmental

- Climate change: Aviation is one of the fastest growing sources of greenhouse gases, and UK airports are set to increase capacity by 59 per cent by 2050

- Noise level control

- Media attention on environmentally-friendly social changes

- Train travel might gain more share in the transportation industry – less passengers, less profit

- Impact to being able to fly due to stormy weather / climate change

Read the Ultimate Guide to PESTLE Analysis.

Five Forces for easyJet

Industry Rivalry: High

- Similar yield management systems (e.g. overbooking)

- Fixed costs are high (full capacity is crucial). When demand decreases, prices go down to achieve it.

- Some competitors have gone bust, but Jet2 is expanding its fleet

- Market share relatively evenly balanced: service processes and routes have little differentiation. Switching costs are low; no airline can maintain a segment of the market.

- Market growth is slowing down (UK airports slowed down to +2.9% in 2018 compared to +7.1% in 2016, but it’s expected to pick up from 2020

- Exit barriers are very high (capital required to purchase and maintain aircraft fleet, licences etc.), making companies reluctant to leave and instead reduce prices

- Relatively high dominance in the market (among low- cost carriers) but competitors’ price, services and flight network are increasingly similar, which means that EasyJet should focus on other sustainable competitive advantage.

- Direct competitors to EasyJet: few but big in size.

- Differentiation: unique add-on services on-board, by expanding flight routes or by ensuring high quality service throughout every touchpoint, making travelling hassle-free and affordable.

- It should consider expanding its fleet in accordance with predictions of market growth to ensure dominance.

Threat from New Entry: Low

- Massive initial capital is required- aircraft fleet, licences, certificates, training, operating costs etc

- Market is slowing down, competition is fierce and social and environmental changes make aviation industry an unattractive business.

- Most customers prefer flying with companies that they trust and feel safer.

Threat from Substitutes: Medium

- As mentioned above, the threat of substitutes is relatively potent as technological innovations in start- up companies place a threat to aviation industry.

- These attempts are also propelled by social and environmental demands from the market.

- Already existing substitutes (e.g. train, car-sharing, boat) take longer, causing inconvenience; and are oftentimes not any cheaper.

Threat from Suppliers: High

- Sole supplier: Airbus (components through partnerships etc.)

- Suppliers are dependent on airline companies. They include airport parking contractors as well

- Increasing oil prices

- Future implications of environmentally-friendly suppliers and materials – potential increase in the threat of suppliers

- Suppliers are dependent on airlines. However, since there’s a high cost of aircraft output, suppliers do provide threat by increasing prices or changing T&C/arrangements.

- easyJet should focus on creating efficient supply chain management, good relationships, attaining multiple back-up suppliers, investing in R&D (alternatives to fossil fuel).

Threat from Customers: High

- Sophisticated customers (travel fare metasearch engines)

- They demand low prices, oftentimes the sole priority is to get from A to B for the cheapest price possible. This could put pressure on profitability.

- Low switching costs

- Many other low-cost carriers are available.

- Environmentally-friendly demands from customers to become more crucial

- Reduce the bargaining power of customers: enlarging its customer base and making more customers loyal- to increase switching costs

- Brand image focused on quality service. It should expand on service offerings

- Long-term marketing efforts are required to influence customers’ decision-making process.

Create your own Five Forces with our guide.

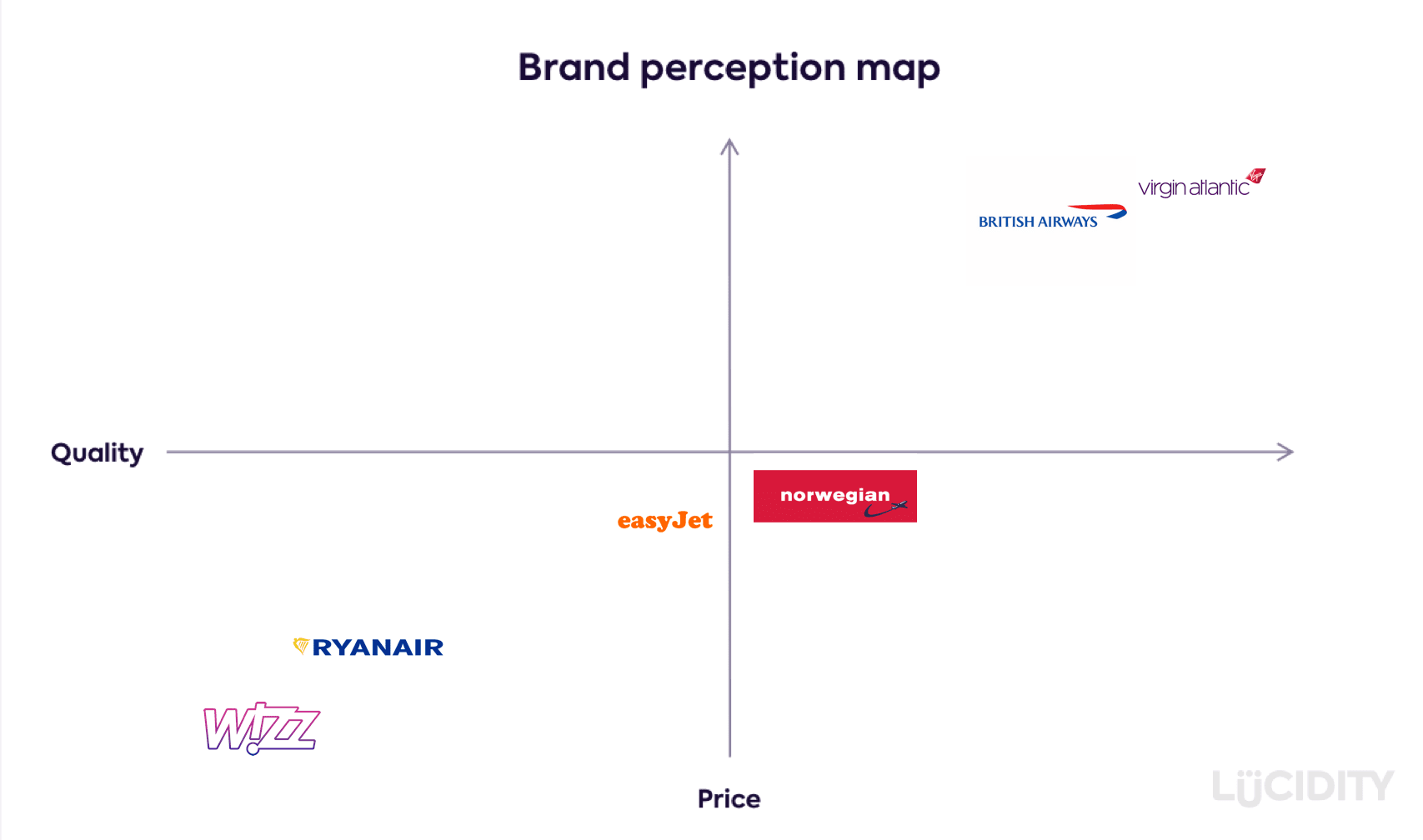

Perceptual Map for easyJet

Brand perception is hard to quantify, but based on personal experience it will be mapped as:

Learn more about Perceptual Maps.

Need help building your own strategy?

Our strategy software makes it faster and easier to formulate a strategy, manage the execution and track the results. Book your personal demo and get a strategy plan template tailored to your organization.