Whether you have gradually realized you are in a turnaround situation, or you have had a sudden epiphany, it’s likely to feel like a fraught, scary situation, with a thousand things to consider. It can be difficult to think critically and make the right decisions when faced with these sorts of challenges.

It’s at times like this it’s good practice to use a few strategy tools, that can help you be objective, consider many variables and structure your thoughts. It can be surprisingly easy to then make the right decisions in how to turnaround your business and you can gain comfort that you’ve made the right choices and prioritized the right things.

So, let’s look at the key questions and key tools in the strict context of turning around your business:

- 1) What’s happened to us? What’s going on around us?

- 2) To survive we must play to our strengths. What are they?

- 3) What are our strategic options and how do we decide which one to go for?

Here we’ll look at Porter’s Five Forces

Here we’ll look at the SWOT tool

Finally, we’ll look at The Ansoff Matrix

1) What’s happened to us? What’s going on around us?

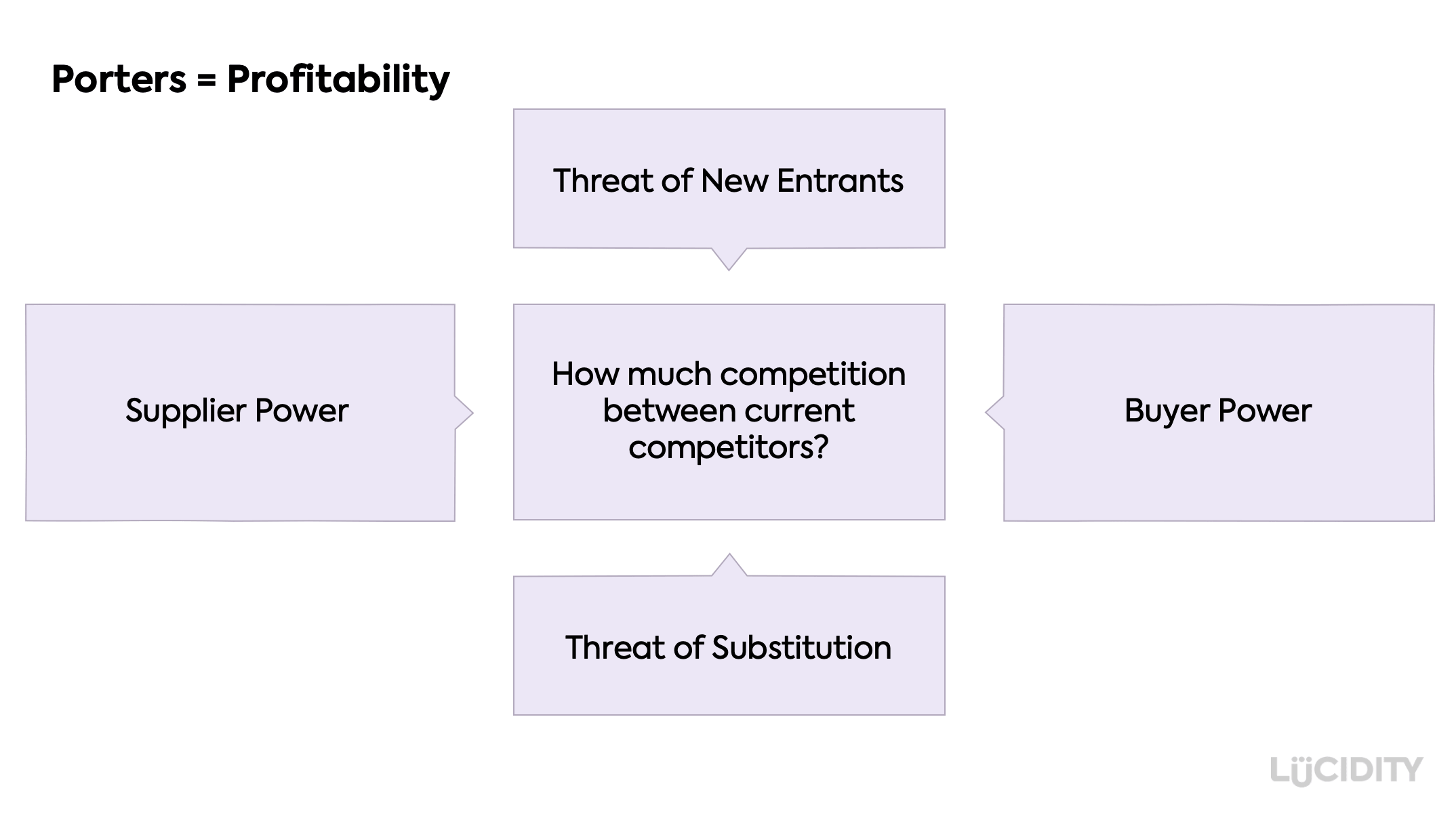

To understand what’s happening to you in your marketplace at times like this, Porters Five Forces is a great tool to use. The role of this tool is quite simple – what’s going on in your market and are you therefore likely to make a profit again? This can help you understand whether to stay in the market and perhaps invest in product development, or whether you are truly in trouble and you need to get out of Dodge City i.e. exit that market and focus on something else.

Porter’s Five Forces Analysis

Let’s quickly explain Porters in the context of turnarounds:

How much competition exists between current competitors? = Competitive Rivalry

How many competitors are there? A few? A lot? Some seriously nasty, mean ones? Obviously if you are up against many, many competitors or huge gorillas then you have to recognize this reality.

The second thing to consider here is how much growth is going on in the market. If there’s not a lot of growth, or indeed the market is in decline, then how are you going to grow? How is limited growth going to be shared out amongst many other businesses? The answer is – it won’t be as it doesn’t exist. You are not going to grow.

Have I just got some new competition and didn’t realise? = Threat of New Entrants

Have you seen a decline in sales because someone, somewhere has come into your marketplace? Competition can emerge very quickly these days and come in from different markets and different geographies. Has this happened and who are they?

Has there been some innovation somewhere? = Threat of Substitution

Digital cameras took out the film industry. The iPhone took out digital cameras, and a lot of other products. Have you seen a decline in sales because someone, somewhere has created a new product that makes your product or service obsolete?

Have my costs changed, and have I got any options to affect my cost base? = Supplier Power

What does your cost base look like given that you may need to change it substantially to survive? Are you stuck in long-term contracts? Is your choice limited to only one or two providers? Can you substantially renegotiate terms or use something else? You need to establish what options you have with your suppliers and what the balance of power is between you and them. Your objective here is to be objective about what control you have on your costs.

How stable is our customer base? Are they going to disappear? = Buyer Power

Customer churn is a killer for any business. If your customers have a lot of power – they have many choices, they can easily survey their options and your competition, see lots of different pricing and they can come and go easily with no commitment. If that’s all true, then that’s obviously a problem for you. You need to consider whether they are likely to stay if, as part of a turnaround, you make changes to what they receive or experience. You must anticipate this and plan around it.

OK so I’ve done that now what??!?

If all of those forces are low – low rivalry, low threat of substitution etc – then stay in the marketplace. You obviously need to do something to turn your business around but doing something completely different doesn’t look necessary

If all of those forces are high – lots of competitive rivalry, high threat of substitution etc – then stay in the marketplace. You need to identify your strategic options (keep reading!) and do something else that will allow you to survive and grow.

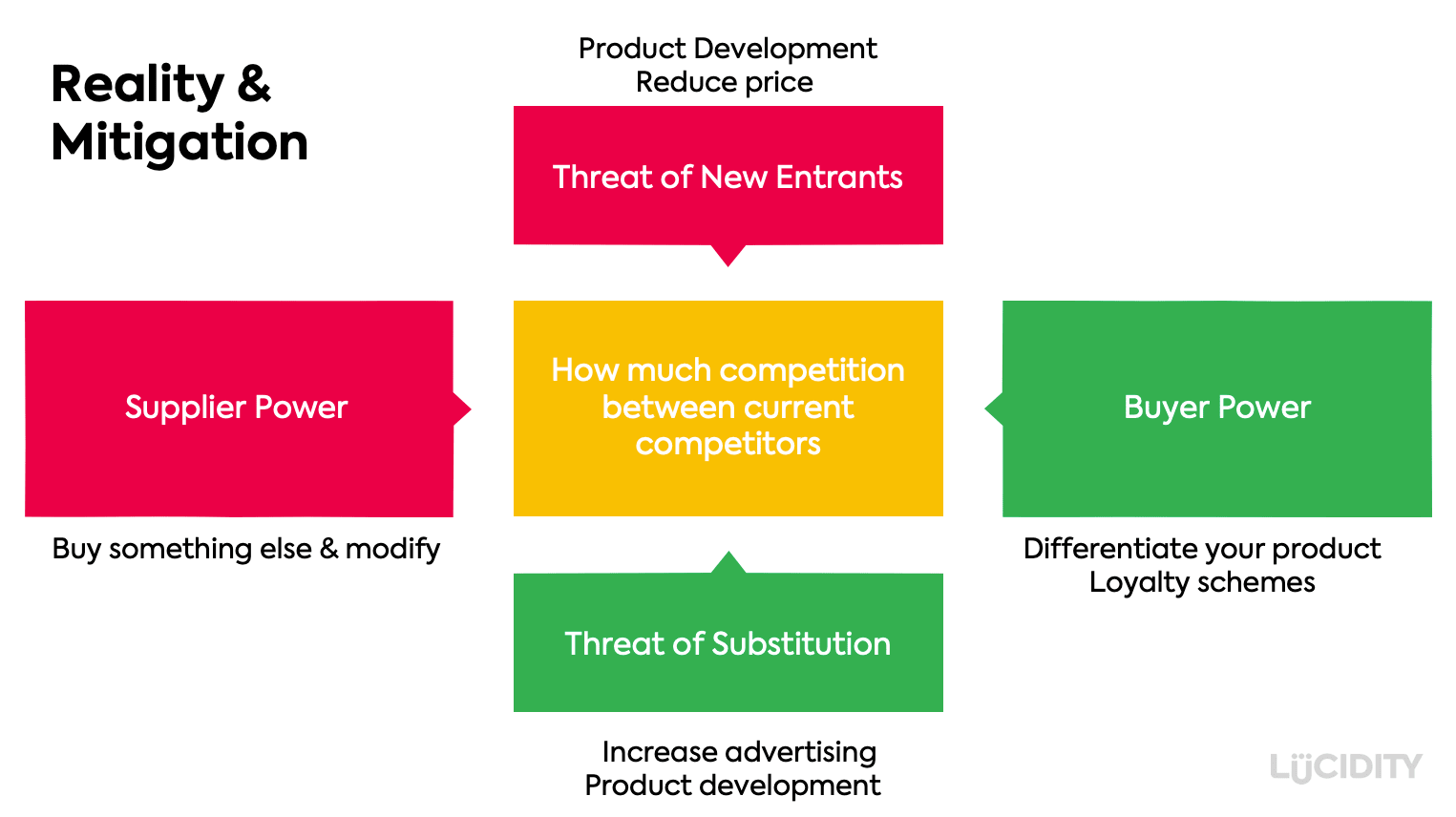

Unfortunately, reality is somewhat more complicated, and you’ll likely see something like this – a mixture of highs and lows, or red, ambers and greens.

Ways to turnaround your business if you’re staying in your current market

Let’s imagine that overall, on the balance of Porter’s analysis, you want to stay in the marketplace. What approaches could you take as part of your turnaround? How can you mitigate against problems? Here are some suggestions that could become part of your turnaround strategy and become strategic objectives, goals and initiatives.

Competitive Rivalry

You have three choices here for your own competitive strategy…

- Change your business so that you compete on cost

- Develop your products or services so that they are different to everyone else (differentiated)

- Focus on a niche in the market – pick one type of customer and do everything you can to win just that type of customer

Threat of New Entrants

- Spend time and money on product development to make your products different

- Change your pricing or commercials

- Identify partnerships that may protect you (product innovation or channels to market)

Threat of Substitution

- Spend time and money on product development to make your products stickier

- Speed up innovation

- Increase advertising

- Identify your most loyal type of customer and go and get more of them

Supplier Power

- Negotiate hard to get better pricing or terms

- Move to new suppliers

- Be more innovative in what you buy

- Buy something and modify it to get what you need

- Partner in some way with providers

Buyer Power

- Create new propositions that make you more attractive

- Review your pricing

- Change your pricing strategy

- Create loyalty schemes or similar programmes that encourage customer to stay with you

- Increase advertising

So, reviewing your marketplace with Porters should give you a structured and objective view of:

- A. What’s happened or happening to you

- B. Whether you should you stay & fight it out or start to think about doing something else

- C. If you are going to stay, some ideas about what you need to do as part of your turnaround strategy

2) To survive we must play to our strengths, what are they?

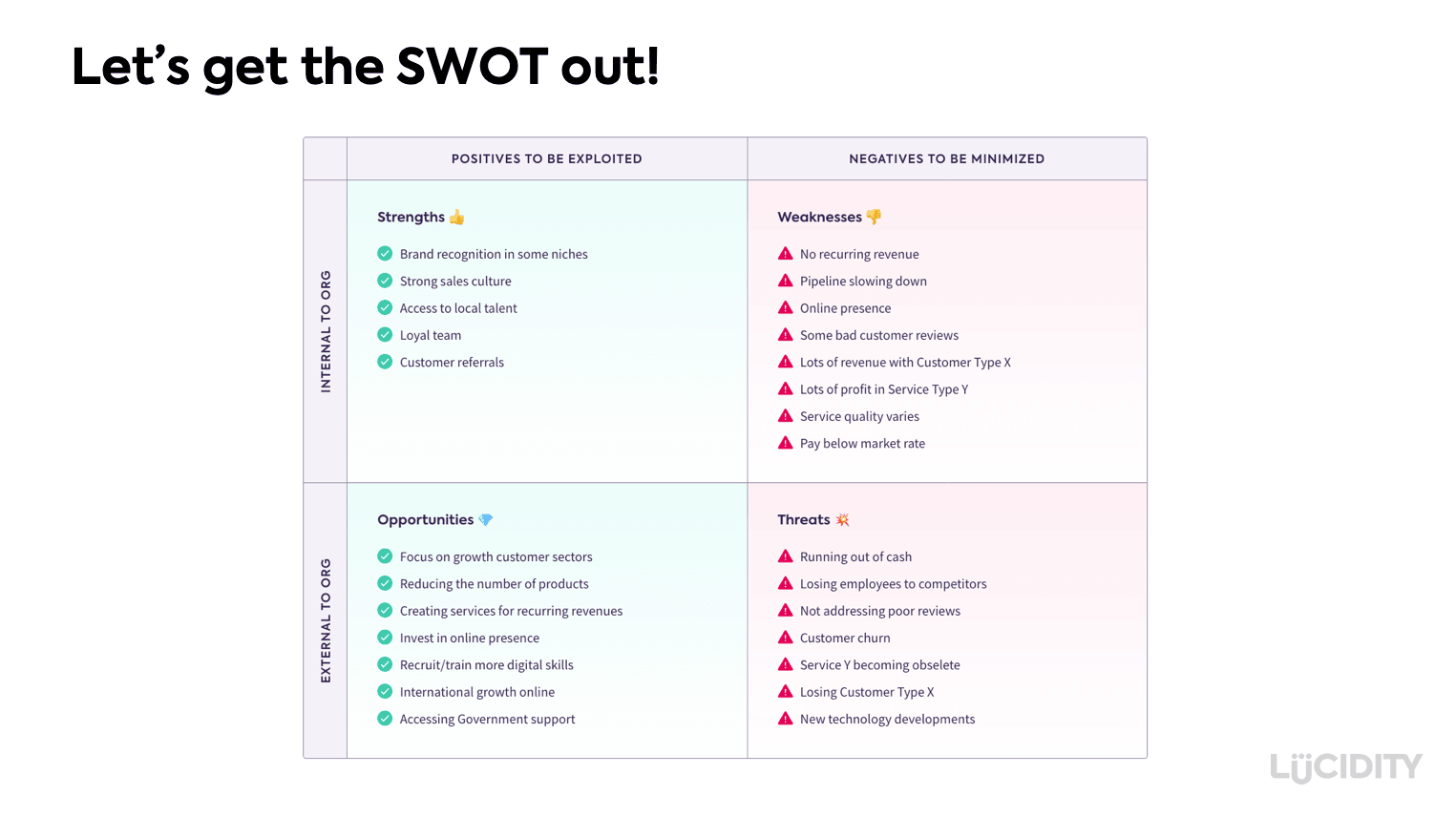

SWOT Analysis

The SWOT matrix is like the Swiss army knife of strategy tools. Functional, indestructible and can be used in all sorts of situations. So, in this case we are going to use SWOT in the context of a turnaround strategy.

It’s common sense that whatever you choose to focus on doing as your turnaround strategy, you need to play to your strengths. Playing to your weaknesses isn’t going to last long, particularly if you are already in a precarious situation. Playing to your strength – and very, very quickly – is a key part of any turnaround strategy. This is a key point so perhaps even read that last sentence again.

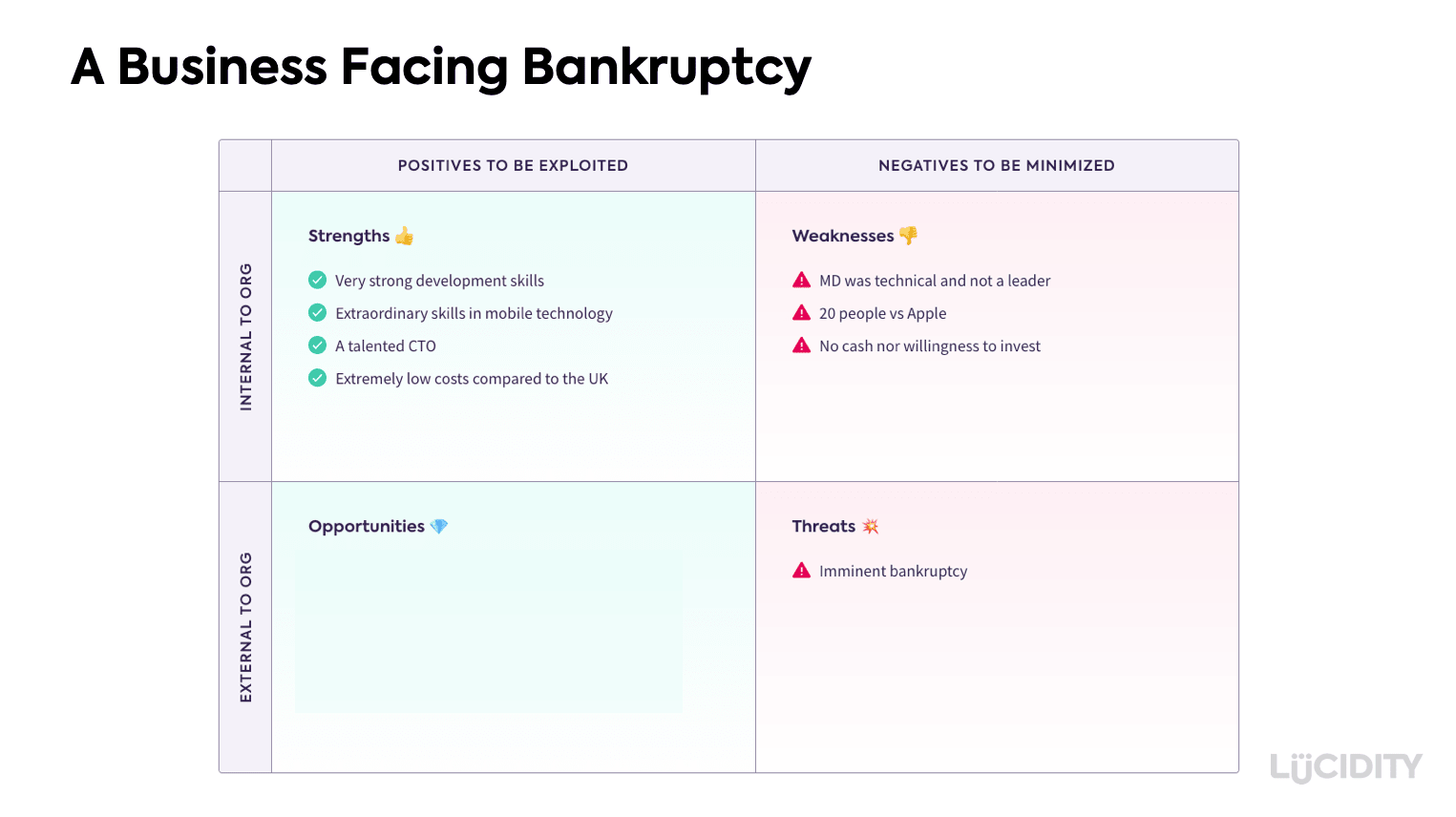

Here’s a typical SWOT and there may be some similarities you can see with your own business. A very quick recap of some basic points before we make things a bit more relevant to a company turnaround:

- Good practice – involve the team, speak to customers – you’ll get a more balanced and honest assessment of things for the SWOT

- Strengths & weaknesses – these are internal to your business

- Opportunities and threats – these are external to your business

OK, so now you’ve spent some time on this, how do you best use this in a turnaround situation? This is a REAL WORLD example folks so get the popcorn and enjoy. The really important point here is the interplay between Strengths and Opportunities. So please watch out for that.

We’d like you to look at the SWOT above in the following order to understand the story:

Threats

This business was facing imminent bankruptcy as….

Weaknesses

They were 20 people and Apple had just substituted their product with the iPhone. The founders/shareholders weren’t willing to bail out the business. The 20 employees were totally *****ed.

Strengths

So, let’s look at the strengths because this will help us figure out what our options are. Strengths will start to provide some rays of light, some light at the end of a pitch-black tunnel. In this case:

- The team had extremely strong software development skills. They were used to building and maintaining software platforms that were used by large numbers of consumer customers

- They had particular skills, really specialized skills, in software for mobile devices and for all mobile devices to work with their software

- The CTO was a talented employee. Good technical leadership, good customer facing skills, project management skills, he could really lead and galvanize the team and deliver complex work to clients in a good way

- Based in Poland they had really, REALLY low costs compared to the UK or the US. Their low-cost base was a strength

This is a critical point in the process of identifying what the turnaround strategy could be – the ideas and Strategic Options need to come from:

- Playing to your Strengths

- Aiming for a result/scenario that side steps all Weaknesses

So how do we assess what Strategic Options there are and which ones to choose. We’ll continue the story. Enter…. The Ansoff Matrix.

3) What are our strategic options and how do we decide which one to go for?

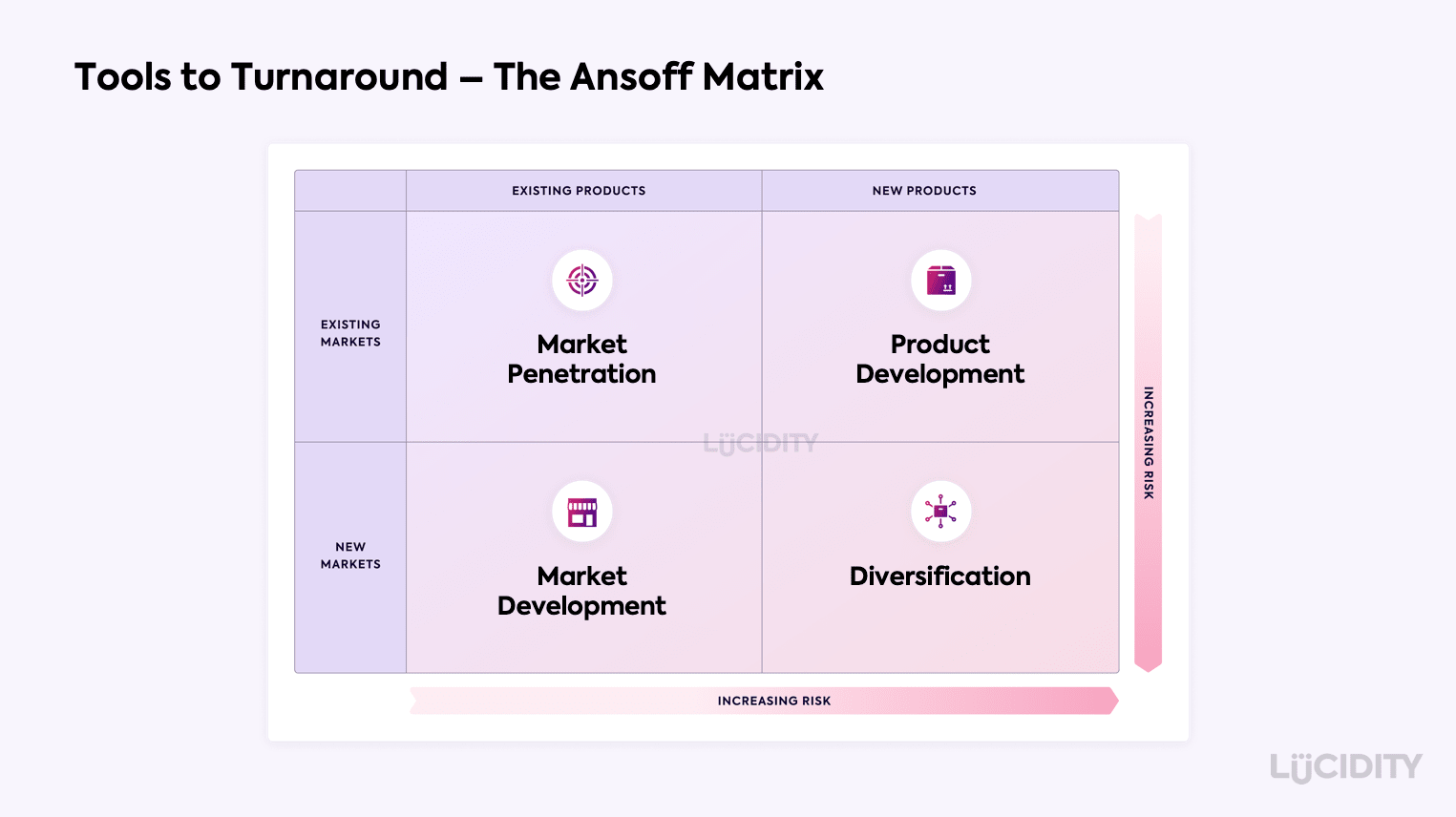

The Ansoff Matrix

The Ansoff Matrix is a great and easy-to-use tool to help you think about and judge strategic options by structuring options to develop new products or develop new markets.

Strategic options are:

Market Penetration

Opportunities to drive growth from your existing products and existing markets. This could be changing your pricing, using a new channel partner, stopping focussing on X to allow more time to focus on Y, etc.

Market Development

Growth opportunities to sell your existing products to new markets. So, for example you sell to insurance companies, you can start selling to banks. Or, of course, geographically you sell in the UK you can start to sell in the US.

Product Development

Opportunities for growth by developing new products to sell to your existing customers. Simple example, you sell cars and you start to sell car insurance; you sell a physical product, you start selling maintenance services. You have a Bronze and Silver product in the range and you develop a more expensive Gold product etc.

Diversification

The highest risk of all and sometimes the only option in a turnaround situation. You need to develop new products and sell them to new customers.

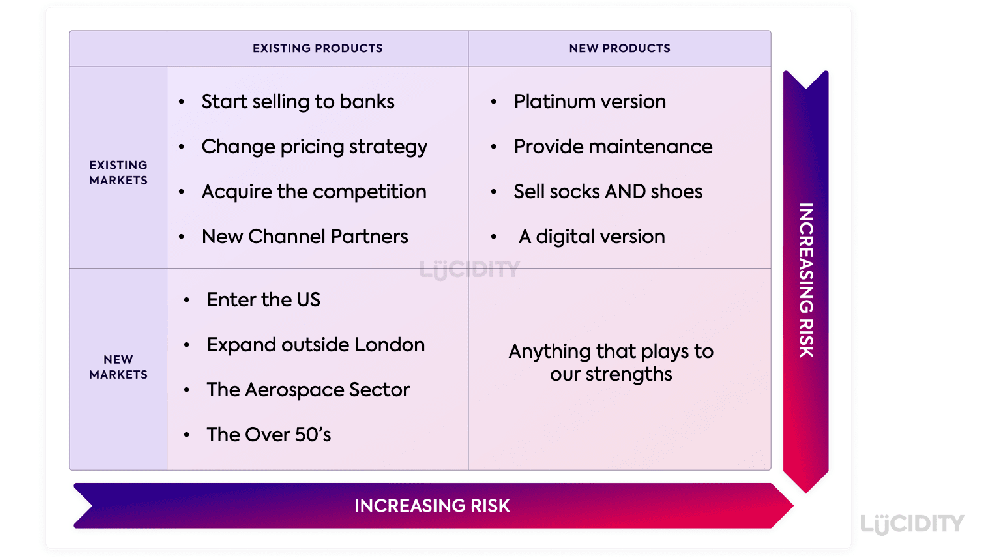

An example of this could look something like this:

In terms of assessing which turnaround options to go for you have a couple of choices in how to decide:

- The SFA Matrix

- Your own scoring methodology

Both are simple to use.

The SFA Matrix

The SFA Matrix is a framework to evaluate your strategic options in order to pick one. SFA stands for Suitability, Feasibility and Acceptability. These are the criteria areas in SFA Analysis used to judge and score each strategy.

Suitability

This criteria is all about the extent to which the activity will help you achieve your business goals. So, will this particular idea contribute to the success of your objectives and overall ambitions for the business.

Acceptability

Acceptability is concerned with the opinions and reactions of your important stakeholders. Will your people get on board with this idea? Getting buy-in is essential for successful execution so this criterion is an important one that considered how aligned everyone will be.

Feasibility

Here you are asking yourself whether the business is actually sufficiently set up to execute this idea. Do you have the necessary skills or resources? Do you have the ability to raise any required finance? Etc.

A simple example from above is:

| Option | Suitability /10 | Acceptability /10 | Feasibility /10 | Total |

|---|---|---|---|---|

| Start selling to banks | 7 | 10 | 8 | 25 |

| Change the pricing strategy | 8 | 10 | 10 | 28 |

| Acquire the competition | 9 | 3 | 0 | 12 |

This would suggest ‘selling to banks’ and ‘changing the pricing strategy’ are two great options as part of the turnaround strategy.

Your Own Scoring Criteria

The SFA matrix is a simple scoring structure. There is no reason you cannot come up with your own objective scoring mechanism based on, for example:

- How much investment it will take?

- How long it will take?

- The level of risk that you see

- The potential level of future growth, beyond the turnaround

- Etc

The methodology is the same – a tabular approach for scoring that allows you to measure and judge which option or options to take as part of your turnaround strategy. Be objective.

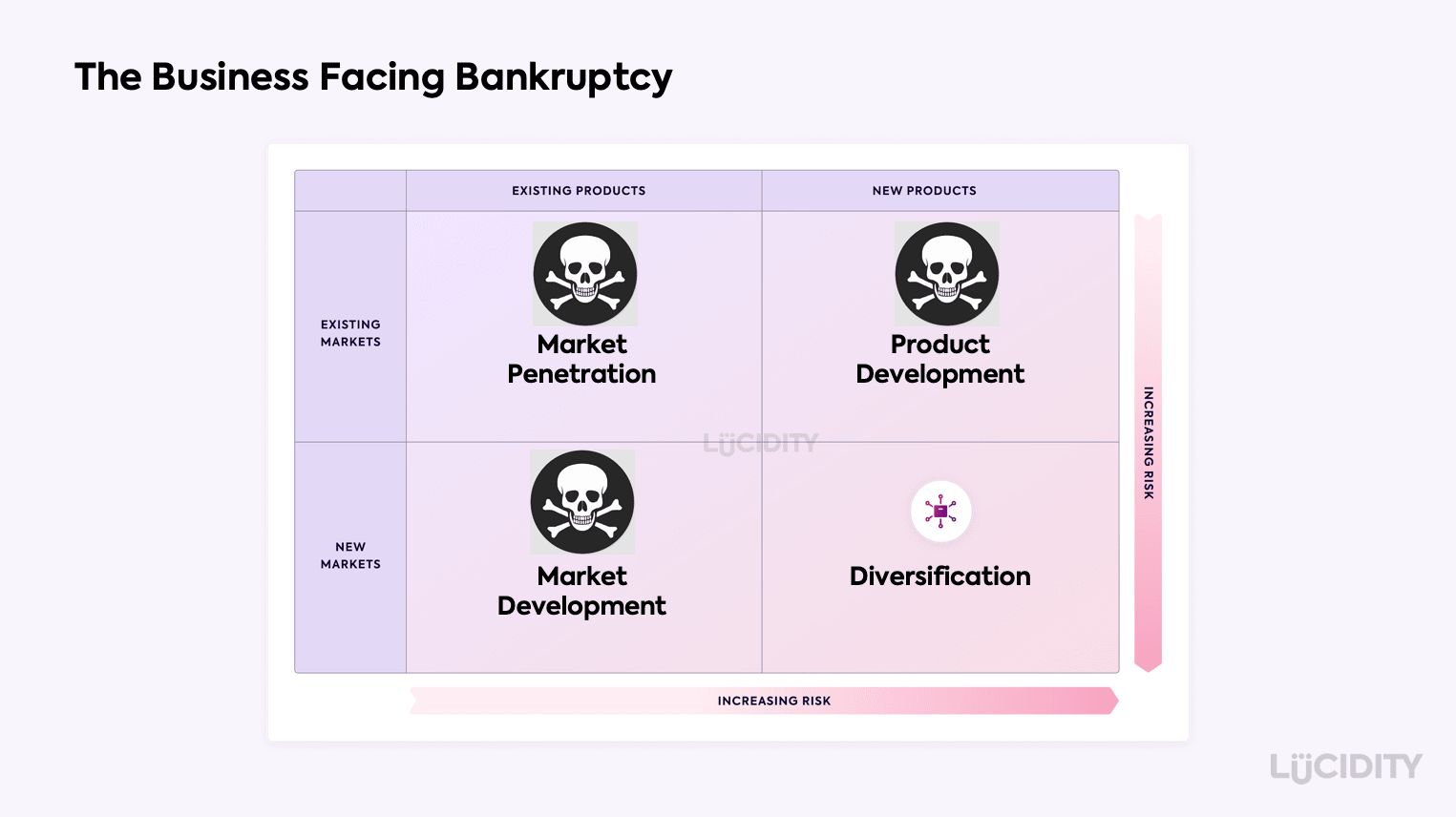

Let’s get back to that business facing bankruptcy…….

The Ansoff Matrix for the business that had just been taken out by Apple looked like this:

Market Penetration – Completely replaced by Apple.

Market Development – Apple is a global business, there was nowhere to go for the small business .

Product Development – The Shareholders wouldn’t invest and it takes a lot of money to develop and market a new product for their B2C customers

Diversification – The only option open to the business. It was do or die.

And so, this business decided to diversify fully, and play to its strengths. The story ends with:

- Leveraging a great tech team and a low-cost base

- Selling software development services (strength) into the UK at a good margin (low-cost base was a strength)

- Did a great job of client management (CTO was great)

- The business immediately went into profit saving everyone’s jobs

- Their biggest customer was so pleased with the skills and service that they acquired the company within 18 months

- Shareholders very happy. Employees very happy. New owner very happy.

Summary

As you can see, in the stressful situation of needing a turnaround strategy, through the use of just a few tools you can quickly:

- Assess what’s happening to you

- Identify what strengths you do have that must be leveraged

- Come up with some strategic options that provide a way towards survival and future growth

Good luck!