This article is around diversification for accountants, specifically in the field of advisory services. There are, of course, other types of diversification. For example, 25% of contestants in The Great British Bake Off 2020 are in accountancy. True diversification in action.

No baking advice in this article though, instead we’ll focus on these four topics, based on our experience working with consultants and accountants taking a look at:

- Current trends in the accountancy market

- Evaluating your opportunity

- Launching a pilot

- Scaling the business

… and if you’d prefer to watch a video on this topic, check out our Launching Business Advisory Services webinar!

Current Trends in Accounting

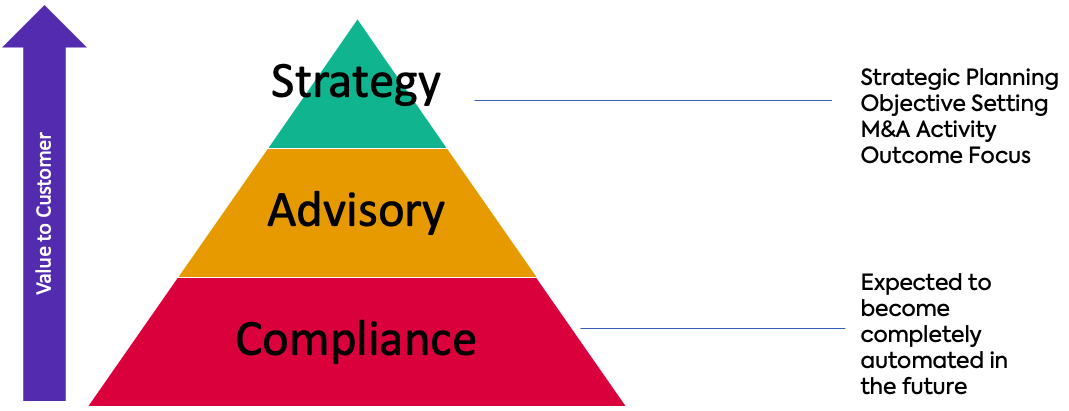

Let’s begin with looking at some current trends. Originally accounting was largely around compliance, with the bulk of money being made from tax returns, VAT returns, and so forth.

Over time this is becoming more automated. With initiatives like Make Tax Digital and software like Xero, the barriers to do this work without an accountant are being reduced and, even when an accountant is used, the time is takes and thus cost is reduced.

It’s now estimated that over 86% of accounting and tax tasks can be automated with software. Compare than to 10 or 20 years ago and that number was much closer to 0.

Over time advisory services became an important part of the mix for accountants. These are areas such as company setup, assistance with individual wealth, or general financial advice. This layer is still larger not automated, although it’s easy to see how sections of it, such as company setup, could begin to be. Rather than automation, an increasing threat here is the specific expert advice that can be found online for free.

This brings us to strategy advisory services. An area that includes helping customers with strategic planning, setting their objectives, understanding what their long term outcome is for the business, any M&A activity, or providing help aligning their finances to their strategic intentions.

As we move up the pyramid the monetary value for these services increases, which is good news as the bottom row is largely expected to become completely automated in the future.

Consequently we’re seeing a transition in the role of accountants for businesses.

Already nearly a third offer strategic services, with a further 13% planning to launch them shortly. That leaves a significant amount not yet moving into this space, some of whom may wind down as compliance becomes more automated, others of which will evolve into a new multi-faceted service.

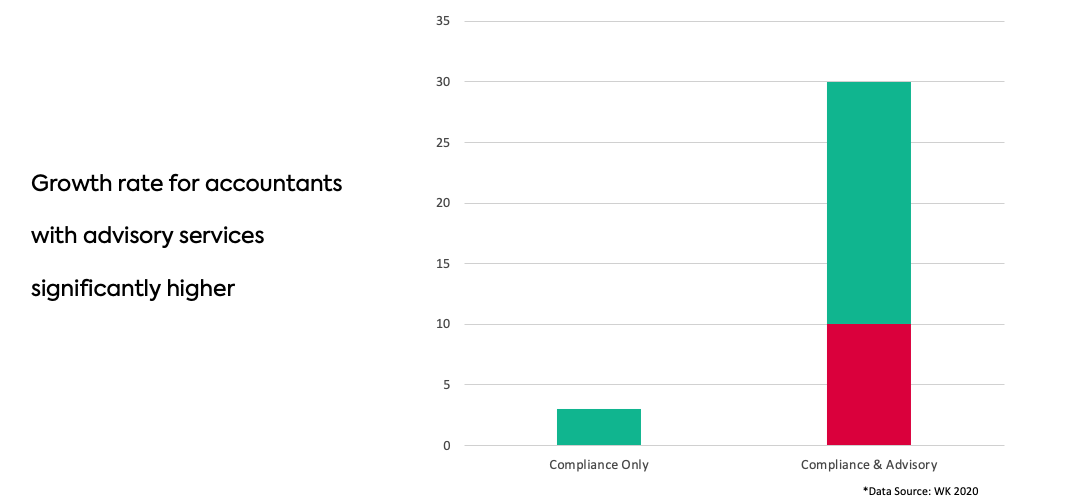

If we take a look at the rate of growth in accountants, we can see that those with advisory services grow between 10-20%, whereas those focused just on compliance are more likely to be 0-3%.

Now let’s take a step back and briefly look at the subject of strategy for SMEs – i.e. your clients. There are common problems and a large need here.

Strategy is often poorly formulated due to a lack of time, knowledge and confidence. It’s seen as nebulous. Consequently only 1 in 20 SMEs have a strategy.

Employees tend not to engage. They don’t relate to the plan, it’s hard to understand, communication is often done poorly with low visibility. So only 13% of staff know a company strategy and, perhaps more alarmingly, only one third of leaders could list any of their strategic objectives.

Finally, strategies fail due to poor management. Lack of consistency or monitoring, content scattered and forgotten about, or no accountability in place. This is a major contributor to the fail rate of companies in general.

Evaluating your Opportunity

Let’s take a look at the wider opportunity.

Continued growth requires behavioural change. Getting your first 20 customers requires different behaviour to getting your 20 – 100, 100 – 1000, etc. This is the same for you and also for your clients. So, without doubt strategy is required to grow, because it can shape and change your behaviour, especially in these times.

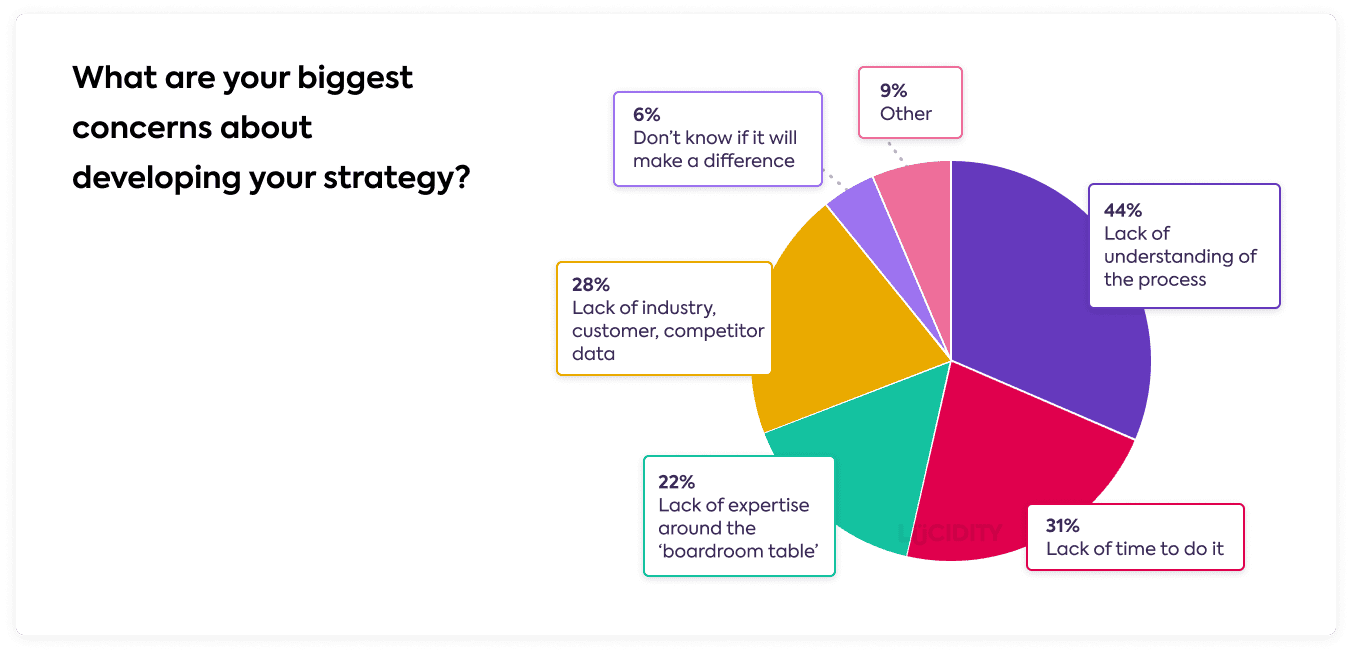

Yet when we looked at hundreds of SMEs, the vast majority don’t have a strategy because they are worried about understanding the process, or feel they have a lack of expertise to do it.

The opportunity to help your clients is huge but clearly, it is also varied. The potential is going to be different per accountant, it’ll depend on your client base and existing revenue. Interestingly, 20% of accountants generate over 40% of revenue from added value services. And this is only expected to grow over time. Sizing your potential revenue comes down to a few factors.

You can take a look at the different markets your clients are in, and look at ones that are in growth. For example, during the Covid-19 situation industries such as Technology and Drugs grew, whereas Oil and Airlines declined. You can target either the growth or the decline, helping the latter turnaround, but you’re more likely to get traction in the former.

Another helpful exercise is to understand which of your clients would take the opportunity. Consider:

- Which are in a growth mindset

- Who have proactive management teams

- Which clients do you have a good relationship with

- Who are the clients who you know want a specific outcome, such as an exit

So, how much revenue will you make per client?

This is difficult to calculate as there are a lot of factors, but let’s look at a real example. The client in question was doing 1-2 million turnover and had a desire to grow the business. The accountant provided:

- Two strategy workshops per year at 7h each

- Two hours per month ongoing reviews

This particular accountant charged £125 an hour, so the total generated was £4,750 per year.

Launching a Pilot

We’re now going to look at the steps you take to launch a pilot business advisory service. It’s quick, easy, and can be really effective.

Step one is to pick the individual who will deliver the pilot. This is an important part because you need to make sure you select someone who is credible and will make it a success. The ideal candidate will be positive, adaptable, interested and passionate, with high emotional intelligence.

Step two to pick your service. Here are some examples…

Goal Setting:

This is normally a day long session to set the goals of a company at a strategic level.

Strategic Review:

This session, again normally a day, is designed to set the major strategic objectives of an organisation

SWOT:

This 2 hour session is based around developing strengths, weaknesses, opportunity and threats, and provides a lot of insight when done well.

Cost Analysis:

As you will know, there are both good and bad costs in a company. This session reviews a company costs and helps them understand what is good and bad, and what they need to do to support their strategy.

External Environment Impact:

A half-day session looking outside the business at all the factors that may impact them over the coming years.

Diversification Options:

Lots of companies want to diversify but don’t quite know how, and of course diversification can mean different things. This session is usually a day and is used to develop and review diversification options.

Revenue Analysis:

An hour session looking at analysing revenue streams in order to help customers decide what they should start, stop and continue doing for growth.

Vision & Mission Setting:

A half day session that helps companies develop inspiring and engaging statements.

The great thing about all of these is they are very templated experiences that provide a lot of value to customers for not a lot of work on your side. We cover these in more details in the webinar.

Clients will respond really well to you, their trusted advisor, getting involved. This approach works for all types of organisation – whether you’re a dentist or a cybersecurity firm.

Scaling the Business

So, you’ve run your pilot. Well done! It’s now time to look at how to scale it within your business.

Your pilot phase is going to result in changes to your offering, which is good as that’s the purpose of doing it. Make sure you setup reviews with your pilot clients to track their progress and align their financial metrics against their strategy.

It’s important to get as much feedback as possible from pilot clients. Learn what they valued and didn’t value and refine your package accordingly.

Next up plan your objectives. This stage is in place to work out what you want to achieve from your strategic services. It might include revenue based targets, number of clients sold, or perhaps number of team members you need to train. At this stage you should nominate an advisory leader in the organisation. Someone who can drive the venture through and will be accountable to the plan. Consider timeframes, targets and how you’ll charge for the services.

Use the structure of Objective, Goals and Tasks to breakdown your launch into easy to monitor components.

Over time you will want to build a team. Remember, compliance and advisory are very different services and you may need to split the offering up between members. Don’t worry if you don’t have the right skills in the company – there are many options to developing the team:

- Hire. There is a lot of talent out there, so you can seek out new employees on LinkedIn or job boards.

- Train. If you have good people there are multiple courses that are possible to do.

- Partner. Partnering with another company to provide the service, such as a strategy consultancy. This is the cheaper option short term but mid to long term becomes much more expensive.

You’re now ready to launch internally. Show the whole company how the service fits in with the business and ask for their support and assistance. They’re going to need to be able to identify potential clients and send you leads for advisory services. It’s important to train the whole team to be able spot the right type of client and enable a simple process to refer those leads.

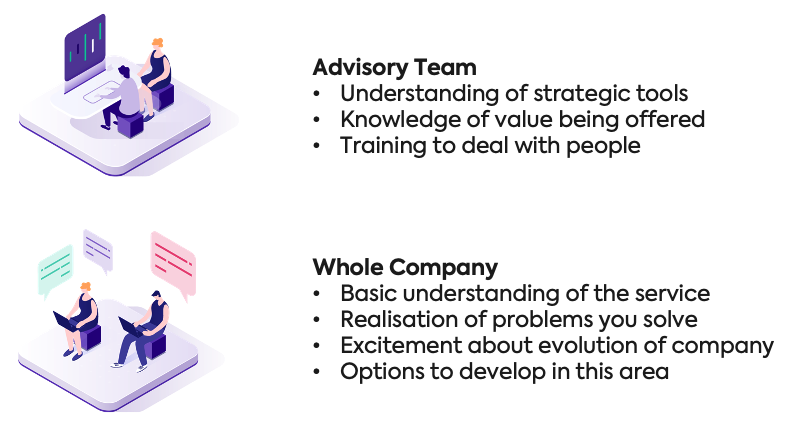

Aligning the company means your advisory team, which may just be one individual to begin with, has a good understanding of strategic tools, knows the value of service being offered and can deal with many types of personality. By contrast the whole company needs just a basic understanding of the service and problems you solve, some excitement about the future, and potential options to develop in this area.

Without doubt you have clients right now who need your help. Providing strategic services to them will result in a win-win and a more successful future for both.

The market is changing and accountants need to adapt to grow or survive, that’s the brutal reality along with millions of SMEs needing your help. The more joyous reality is the opportunity is therefore huge for you, again their trusted advisor, to help and prosper.

And even more joyous – there are lots of tools to help you help them!

Top Tips from Accountants

Let’s wrap this article up by looking at some tips from accountants who have been through this journey.

1/ Consider your own Strategy and Vision – where do you want your accountancy to go?

2/ Pick and Develop the right team for this role

3/ Select good pilot clients. They need to work with you to develop the best offering.

4/ Develop partnerships, either for the tools you use or the services you provide.

5/ Lead with the services you offer when speaking to new clients

6/ Don’t be paper based. It’s so easy to fall into this trap in this industry.

Best of luck in developing your advisory services!